Lite BackOffice User Guide

Iveri Lite is a redirect hosted payment page solution, for card-not-present transactions, designed to facilitate secure and efficient e-commerce payments on merchant websites.

A website developer in the iVeri Merchant BackOffice can configure the look and feel of the secure payment page that is hosted by the iVeri Payment Gateway.

Core Functions in Backoffice

The merchant portal Backoffice allows for the following core functions

- Management of User

- Creation of users

- Transaction Types allowed per user created

- Backoffice functionality views allowed

- Applications permitted on a user created

- Transaction Reports & Listing & Lookups

- Recon Reports

- Blacklisting of cards

- Customise payment request page with Merchant’s Corporate Identity.

- Create Transaction Requests

- Process Subsequent Transactions (Refunds)

Merchant Interface Functionality

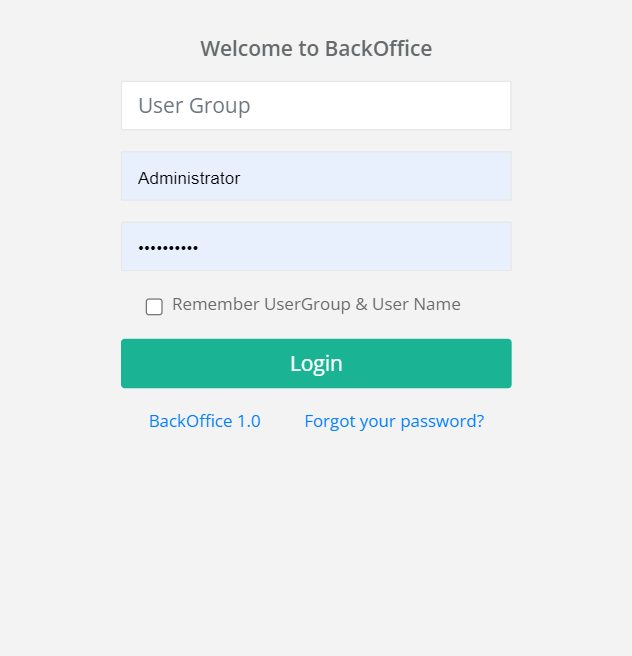

Login

Purpose - To log in to the secure BackOffice Website, login credentials are emailed to the merchant during the take-on process by the acquirer.

Action:

- User Group - enter your Billing Details ID

- User Name - type in Administrator if you are the administrator or the username for the profile that was created.

- Password - this is the Administrator password sent to you with the Billing Details ID by email. Copy and paste it from the email.

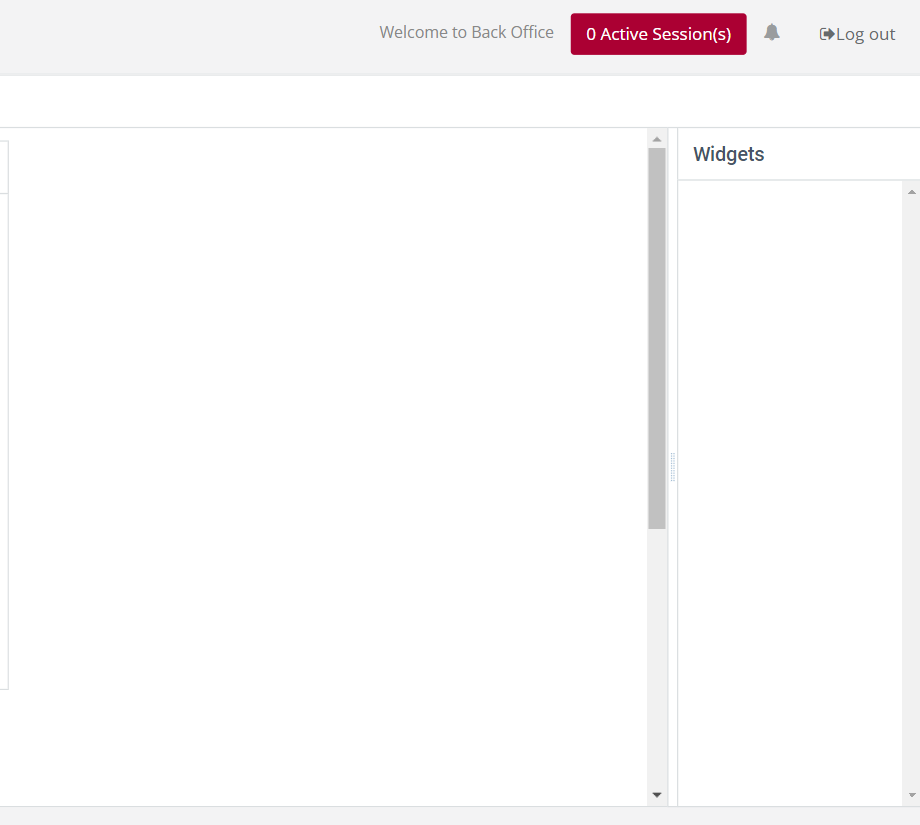

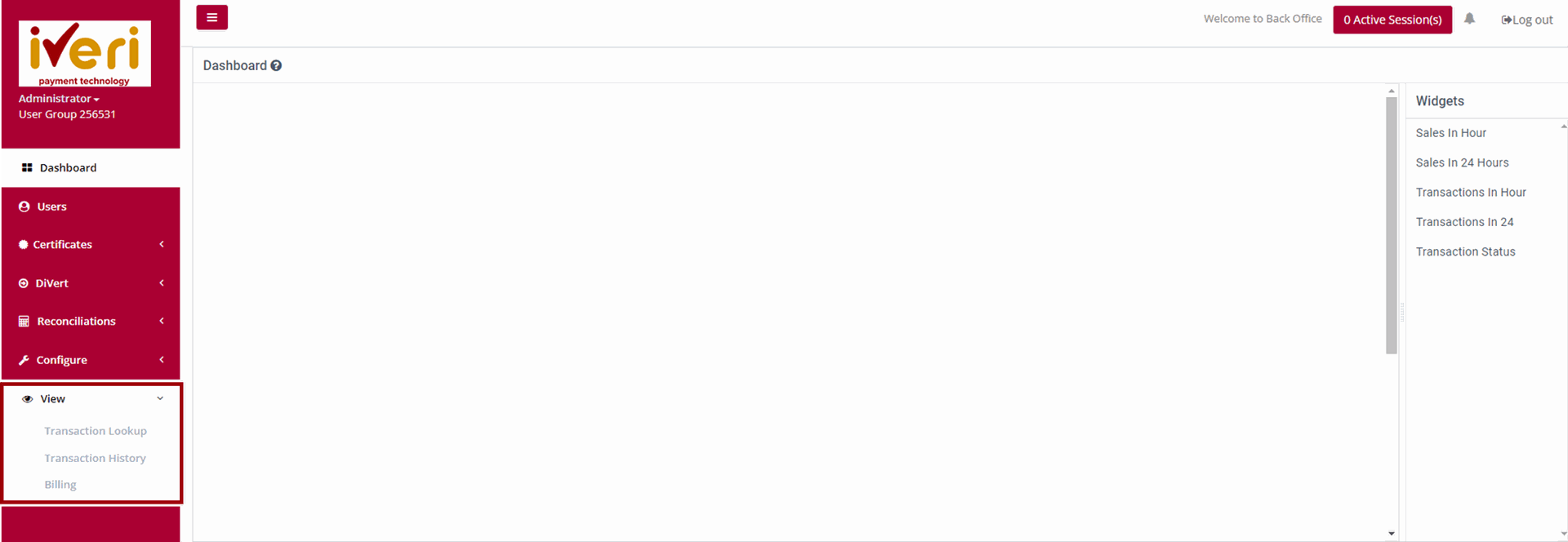

Welcome Page

Purpose - The 'Active Session' tab reflects who is logged in and provides the menu options which the logged in user is able to access or use.

User Manager

Manger the user on your back office

Edit User

Edit – General details

Purpose - To edit/change any of the user information previously captured, or to suspend a user from having access to BackOffice

Action:

Hover over the users’ profile and select on the user’s icon.

Select the Edit button

Make the changes on the Users profile and click Save Changes to action the change.

Please Note:

To change Password of the user to a new one, select either Change Password or reset Password

You can make changes to the Users existing profile. To suspend / disable an users access to BackOffice, navigate to the ‘Enabled’ tab and click on the Radio button. This will suspend / disable the users access. Click on the Save Changes to action the changes.

Add User

Purpose - To add/capture the details for a new user

Action:

Hover over to Users. The following screen will appear.

Select “Add New User” Fill in all the mandatory fields (marked [*]) and click on “Save changes”. A resultant message will be displayed.

Reset Password

Should a user have forgot their login password to BackOffice, navigate to the ‘Forgot your password?’ link.

The system will request you to enter your User Group / Merchant Profile ID and Username.

Once the user clicks on submit, a notification will appear that the user will receive an e-mail notification. The e-mail notification will contain a link that the user will access to change their password.

Now that the user has clicked on the link, they will be redirected to the BackOffice Reset Password page. Enter and confirm the new password. Lastly to action the new password change, click on Reset Password tab.

The following notification will appear on a successful password change.

Service Parameters

Purpose - To allocate the functions within BackOffice in which you (the Administrator) want to allow the new user to have or not have access to

Action:

Select Users, select a particular user, and then select Service Parameters, based on the products used by the merchant choose Yes or No to a particular access rights and limits.

Save Changes once done.

Service Functions

Purpose – Based on the functions that the user has been granted on a particular product these parameters determine the functions to be made available pertaining to the product access a user has.

Action:

Tick on the relevant functions a user is enabled to perform within Backoffice for a particular product.

Save Changes once completed.

Application Parameters

Purpose – This function is used to allocate application ID(s) that a User is only allowed to have access to. This application refers to specific product and what a merchant uses to process transactions through iVeri.

Example below indicates that when you select a particular Application ID an Administrator can configure what functions can this user perform in a particular Application ID. If no function is associated to an Application ID, no access is granted to that user.

Administrator can configure what Transaction Types a user can perform on a specific Application ID.

If no Transaction Types are configured for a user, the user will be unable to process transactions for any of the Application IDs.

Action:

Select the product and Live Application IDs you as an Administrator would like a user to access and configure per product, the Transaction types a user can access by ticking the applicable box under Transaction Types.

Save Changes once complete.

Administrator Password Reset

Purpose – This is used when an Administrator would like to reset their existing password.

Action:

From the menu, select the Administrator area and choose the option to change password.

It is recommended that you use Alphanumeric and Special characters to ensure the password strength meter indicates a strong password.

Save Changes once completed

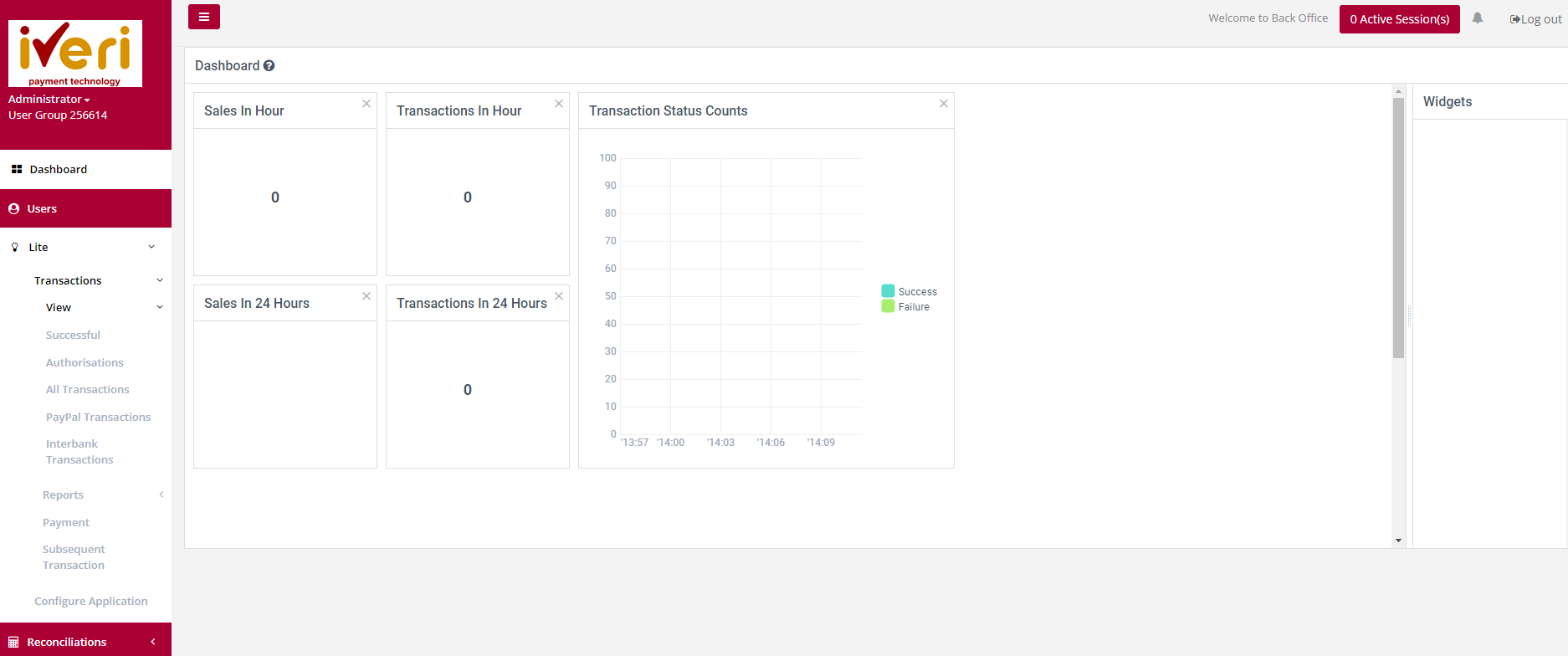

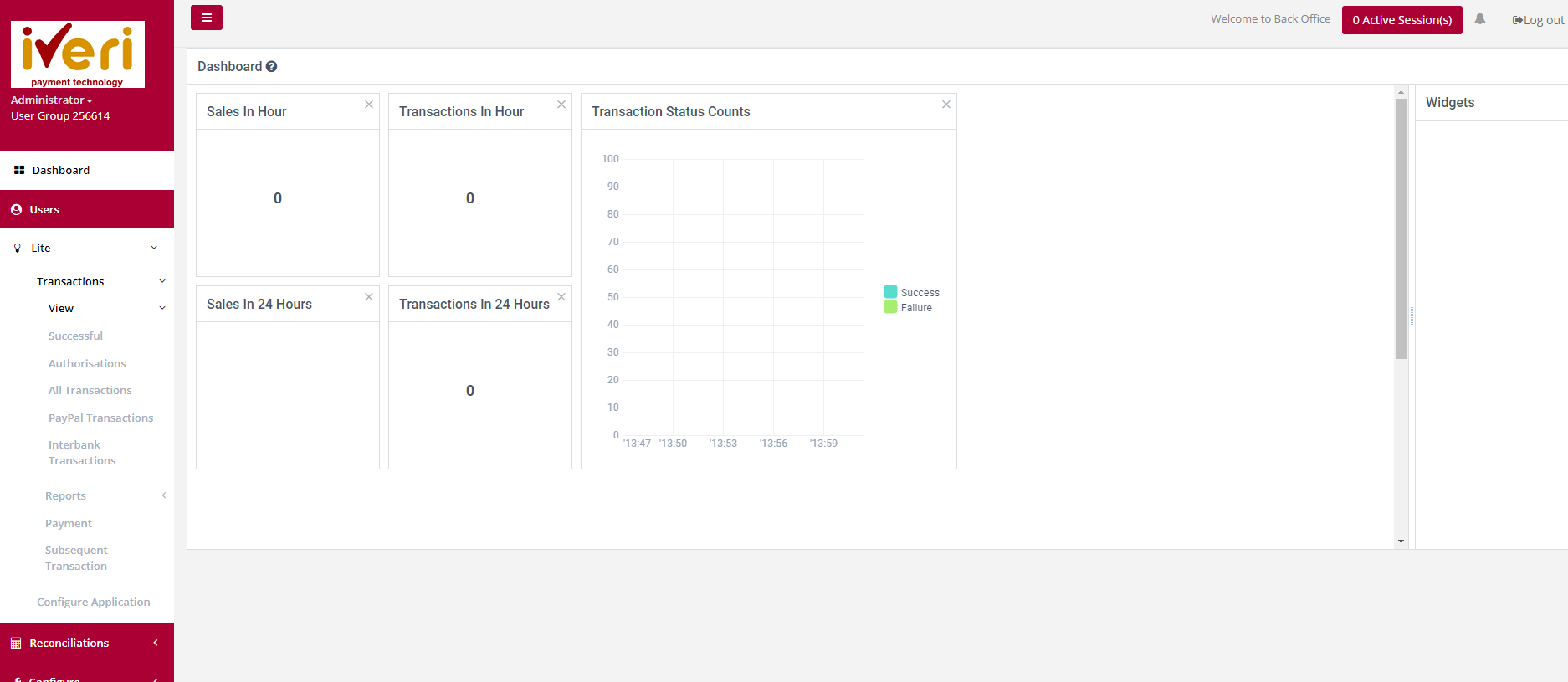

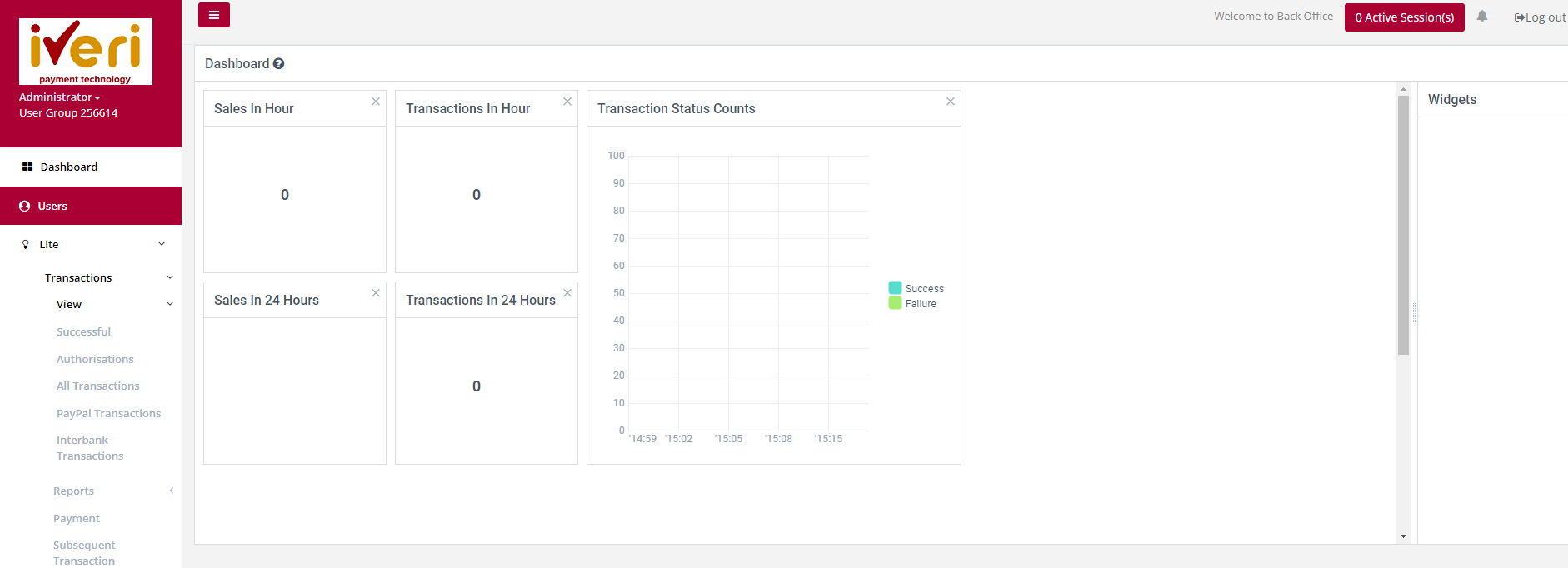

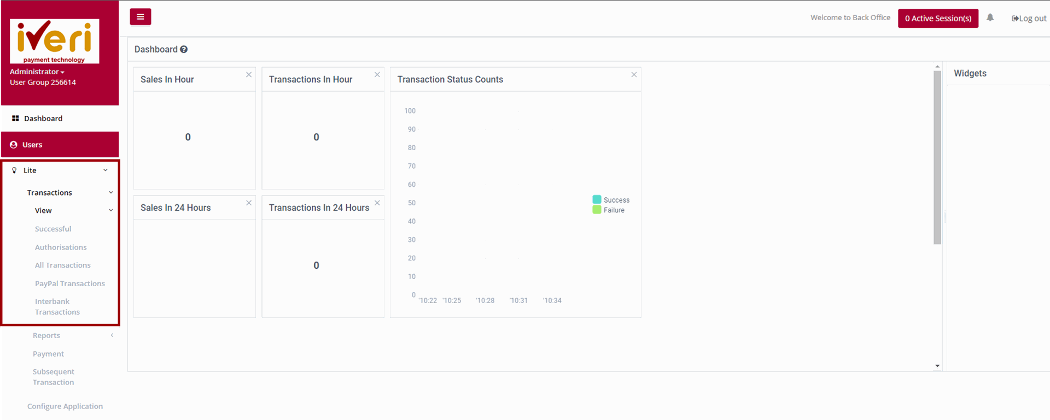

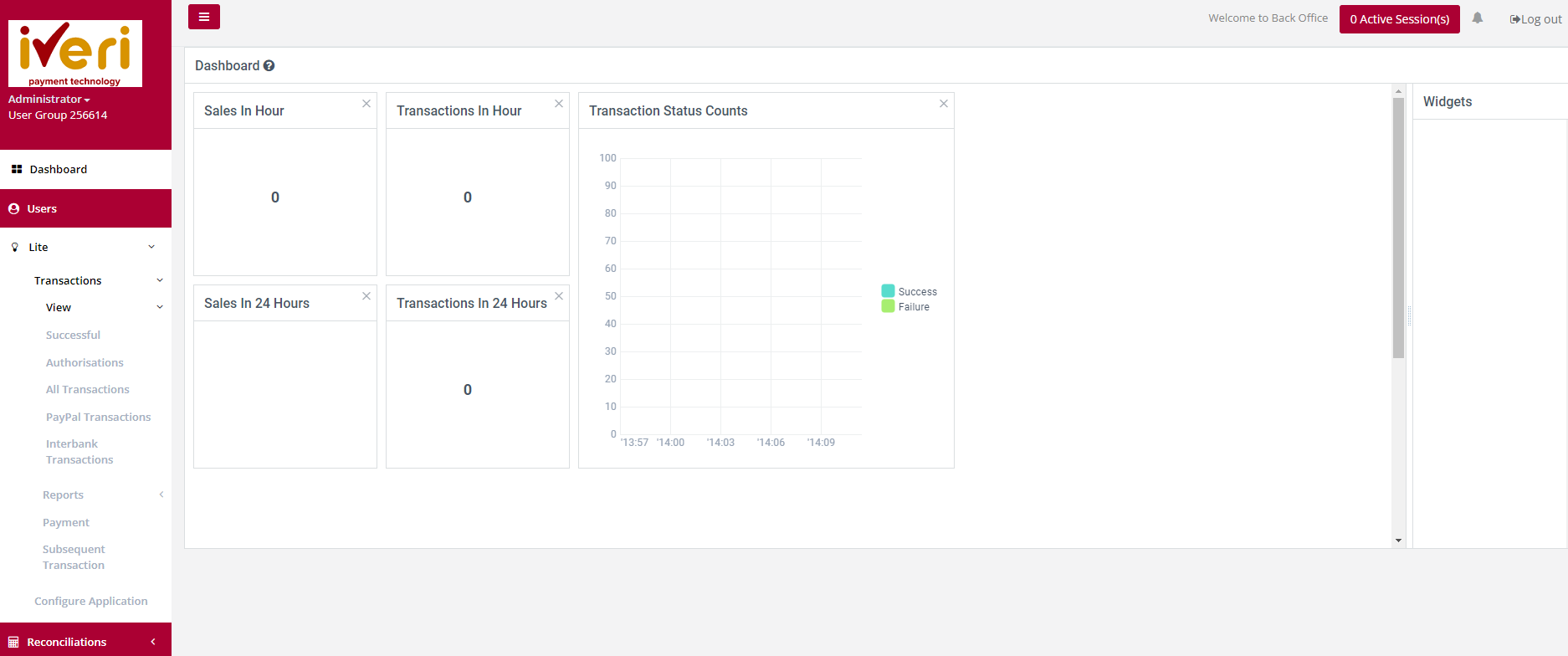

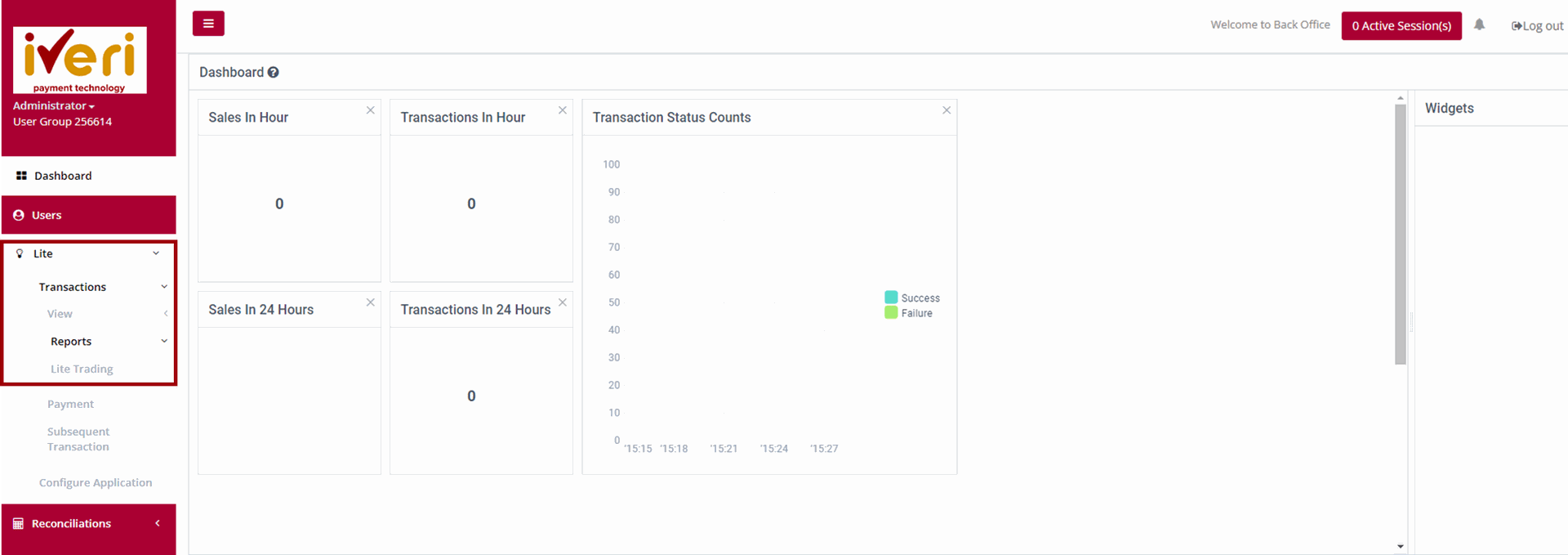

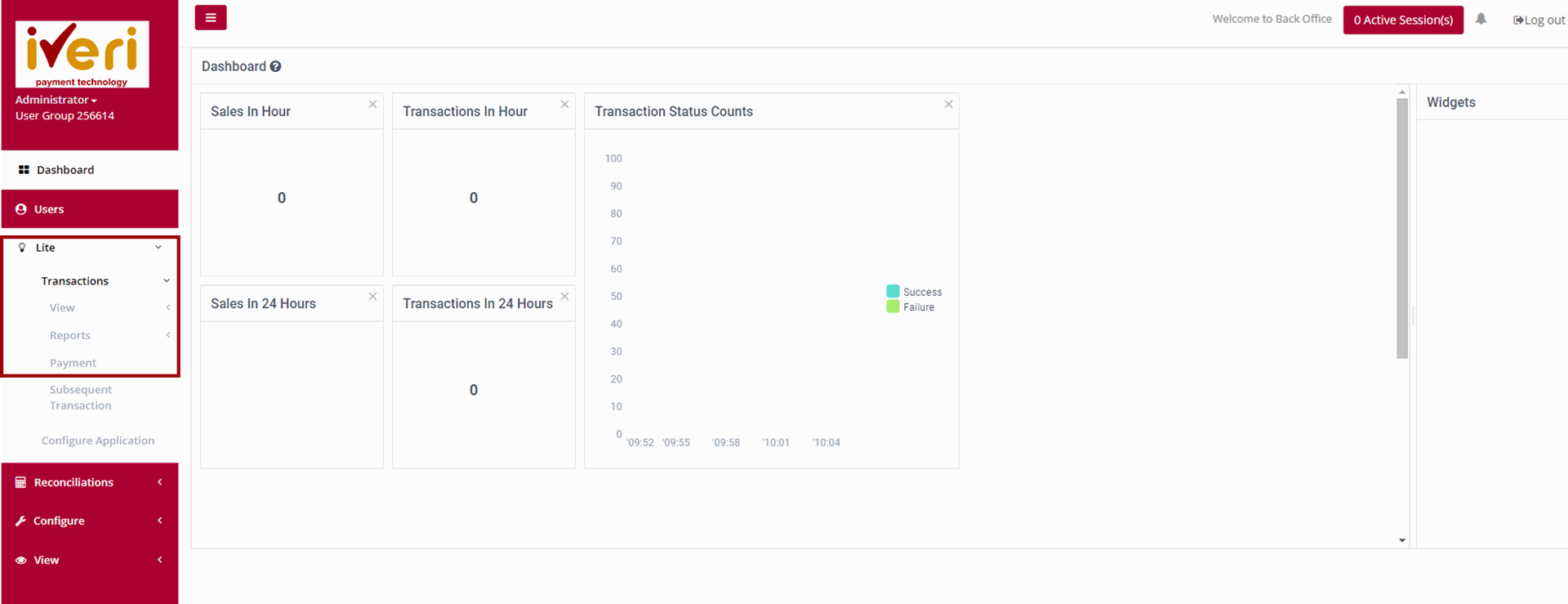

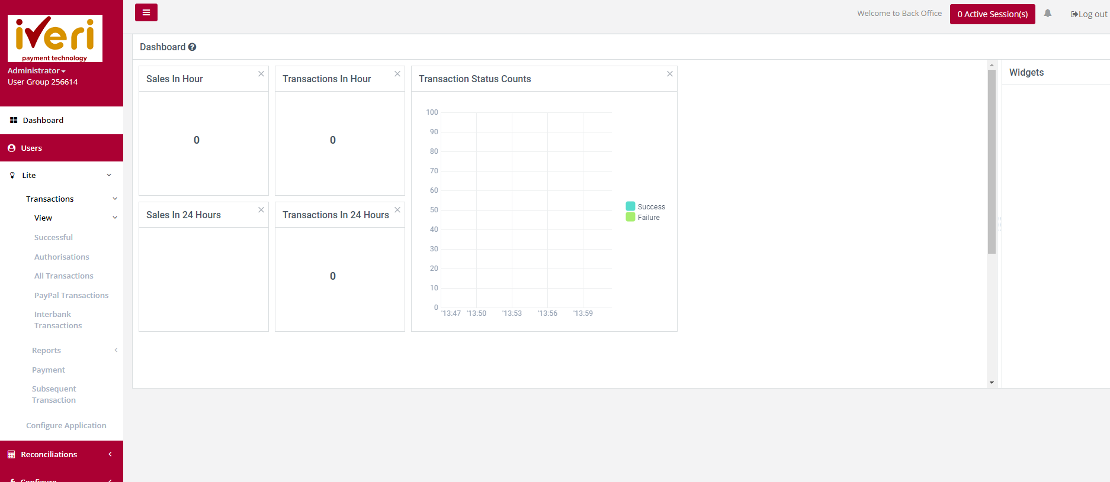

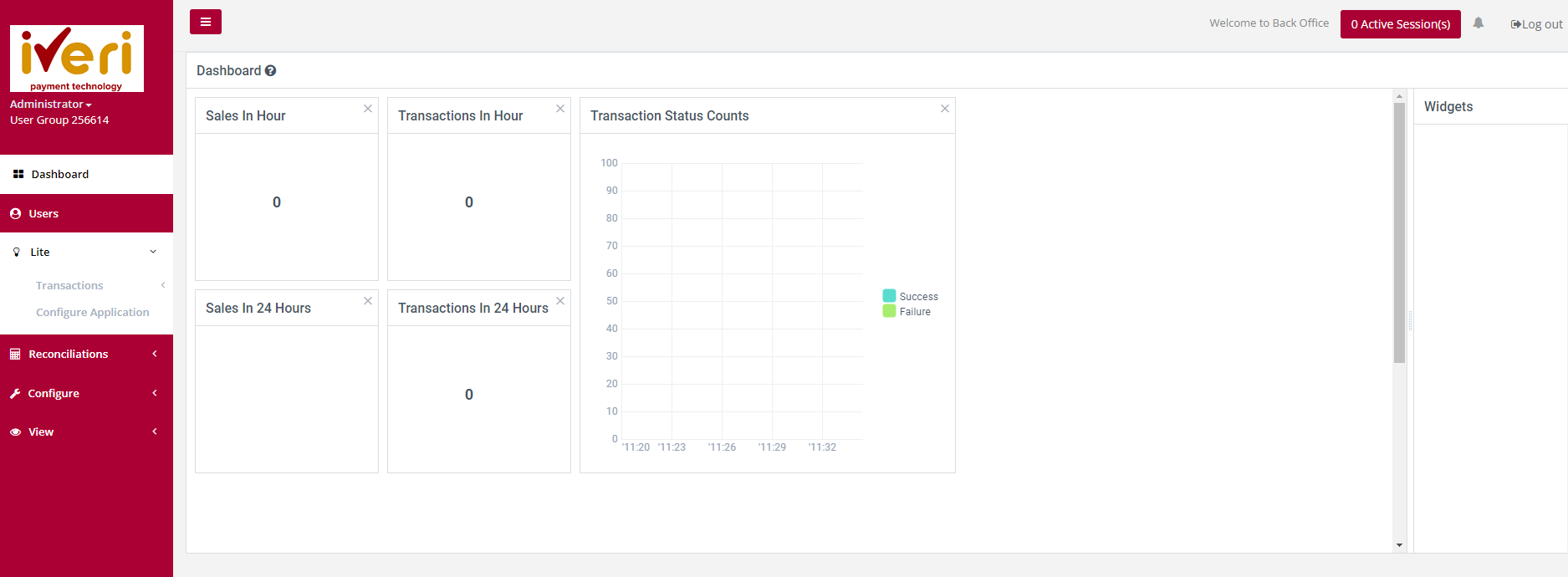

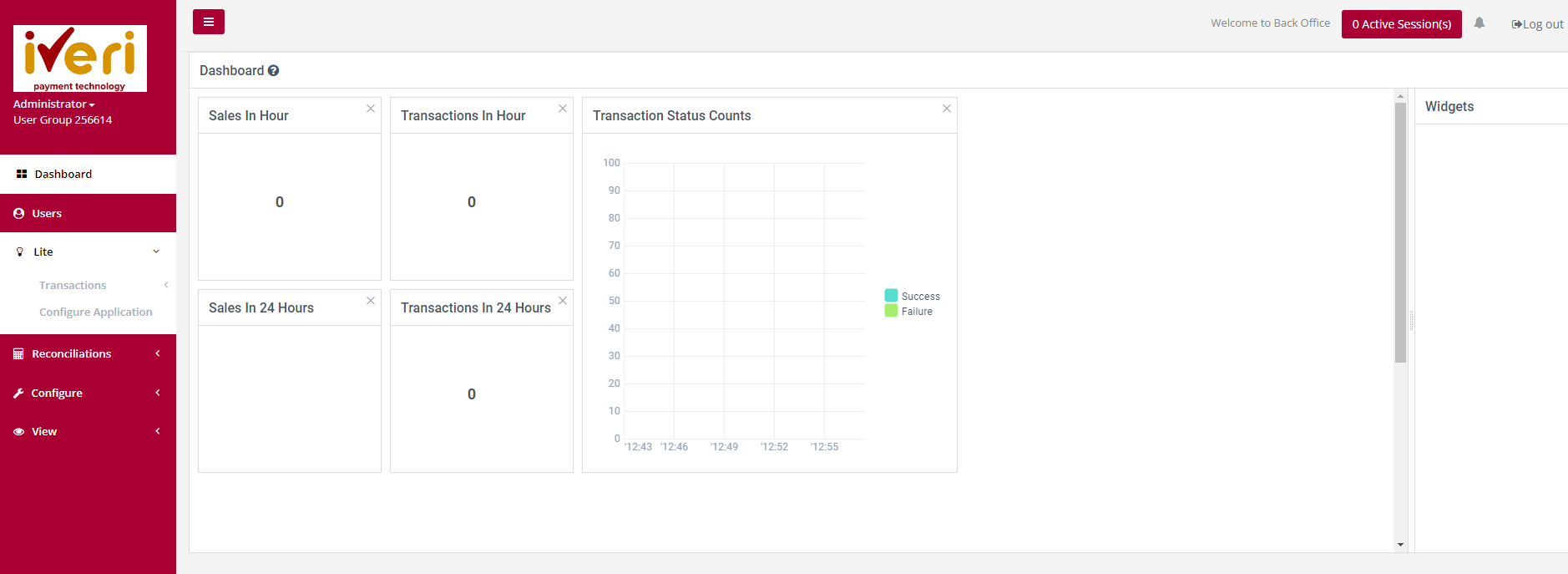

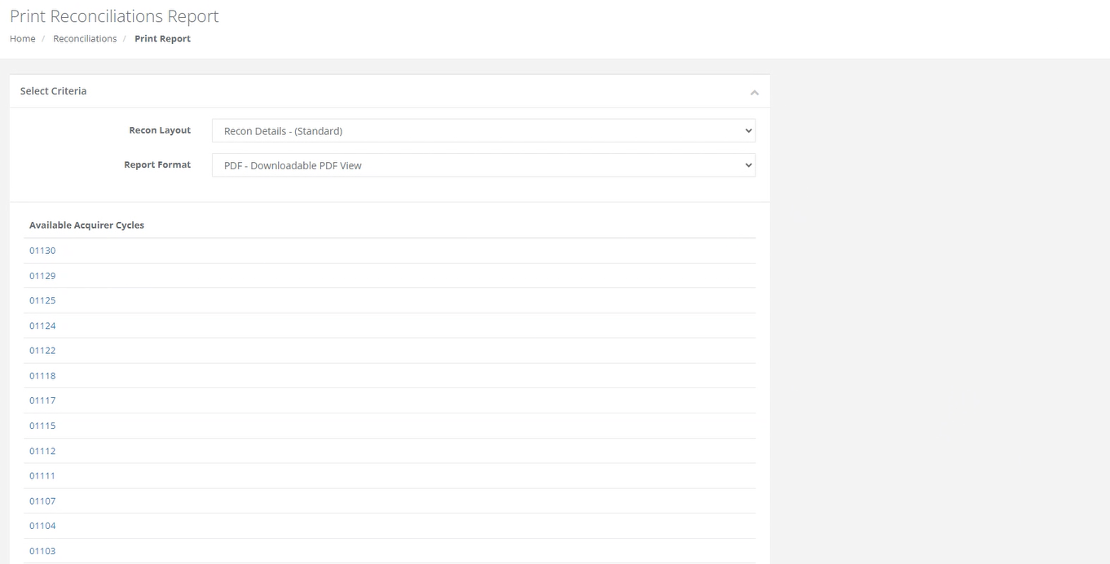

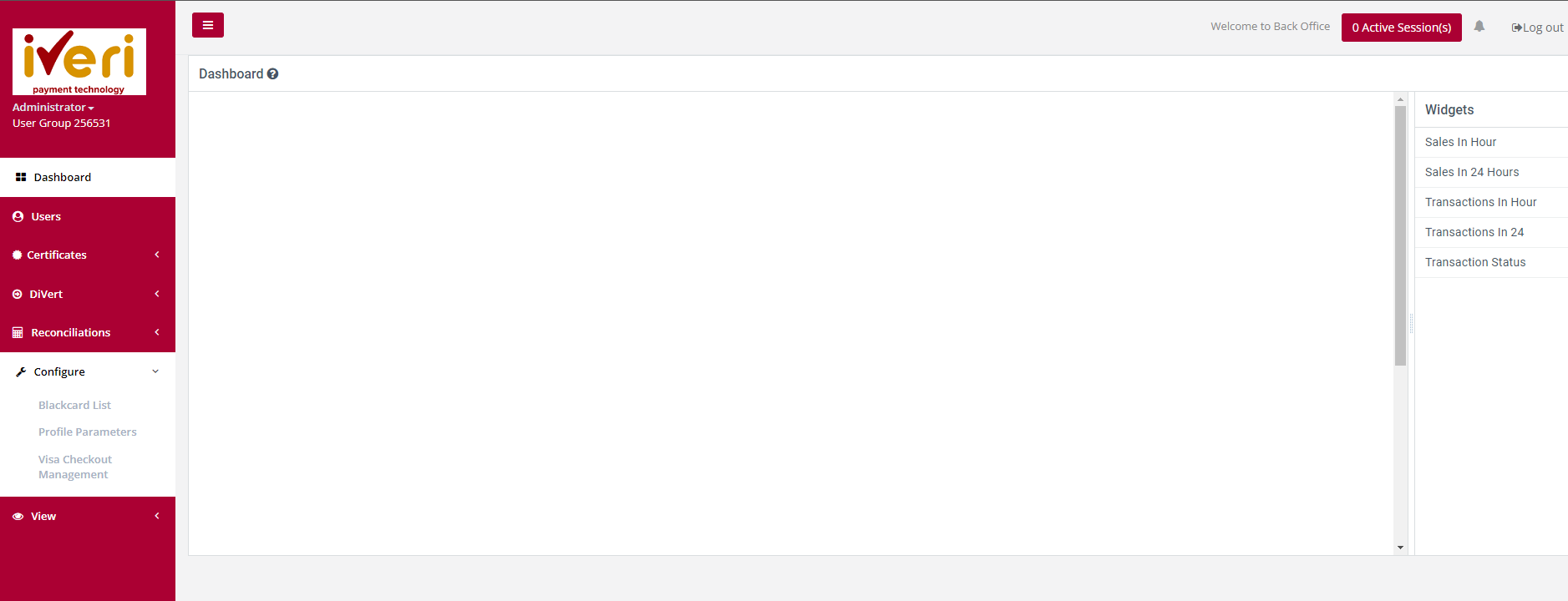

Dashboard

Purpose – The dashboard provides the Merchant with a summary or snapshot of Sales, Transactions and Transaction statuses within a set period of time. Depending on the needs of the Merchant, the dashboard is customisable by dragging and dropping the relevant widgets on the dashboard.

The dashboard offers merchants a comprehensive overview of their sales, transactions, and transaction statuses within a specified time frame. It serves as a realtime snapshot of business performance, enabling merchants to quickly assess key metrics and trends.

To cater to different business needs, the dashboard is fully customizable. Merchants can drag and drop various widgets to tailor the layout, ensuring that the most relevant data is easily accessible. This flexibility allows merchants to focus on the insights that matter most to their operations, such as daily sales trends,payment success rates, or transaction volume breakdowns.

How to customise your dashboard:

From the widgets menu, merchants can select and drag their preferred widgets onto the dashboard, allowing them to customize their view based on their specific business needs.

Lite

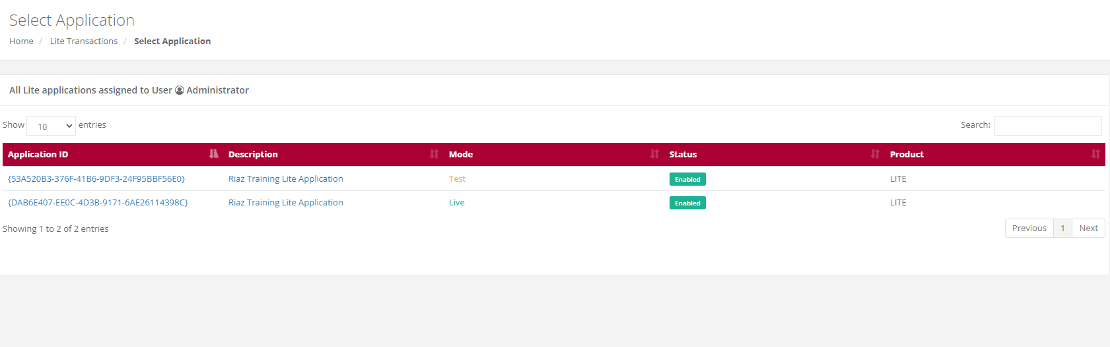

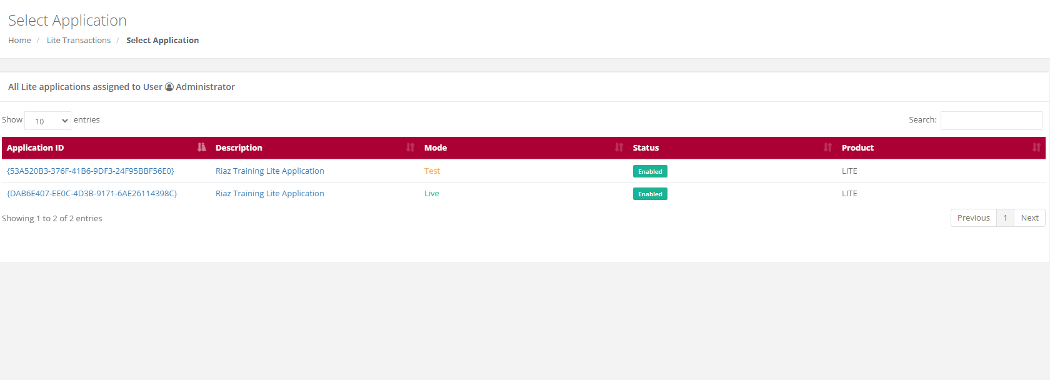

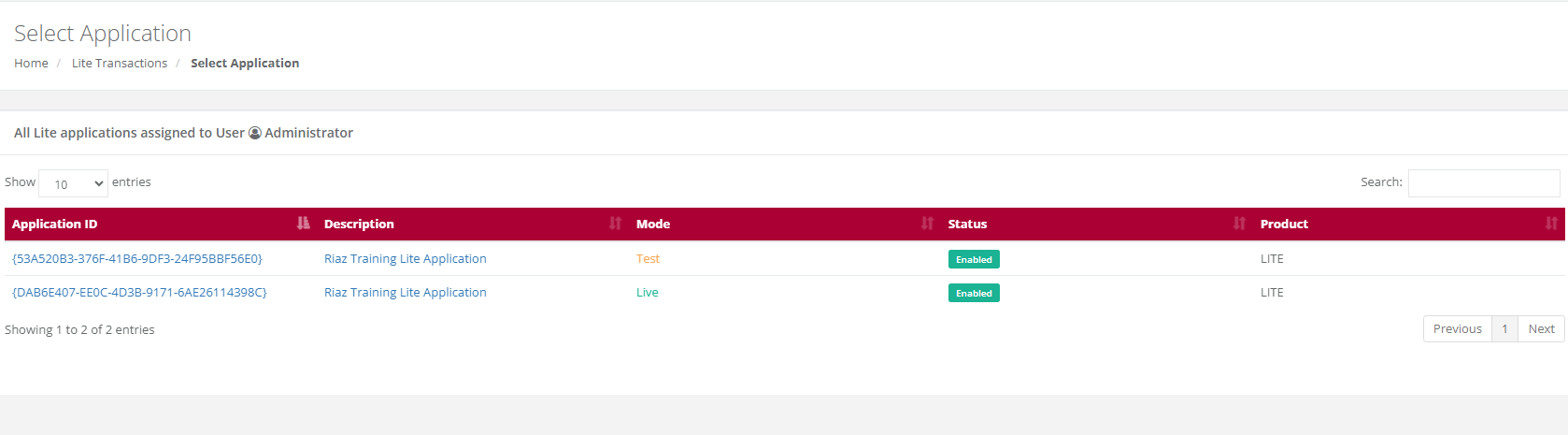

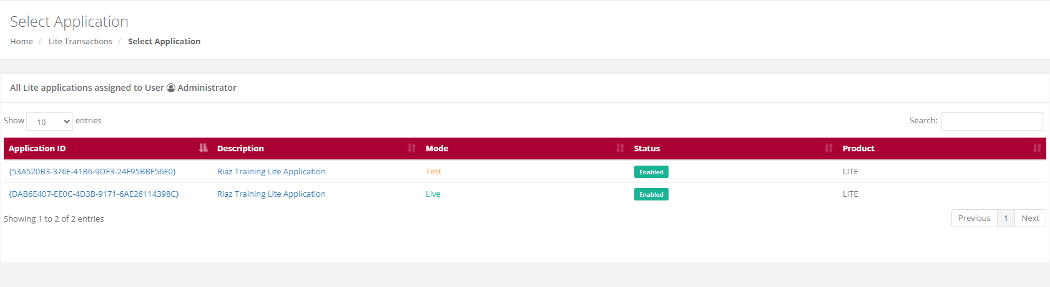

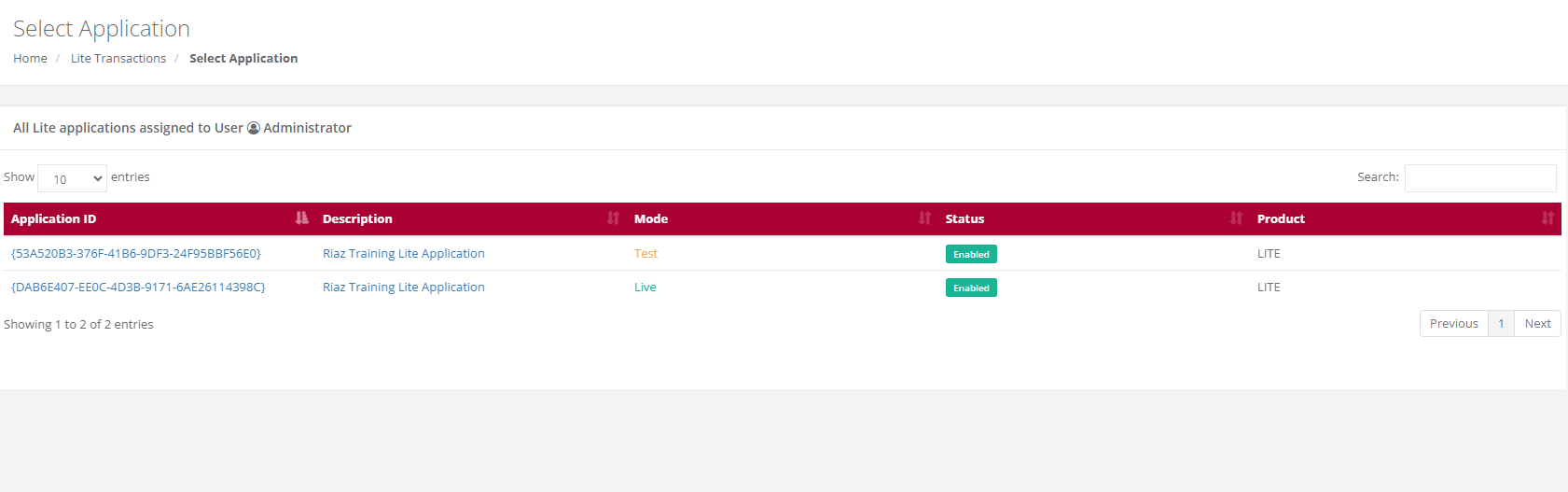

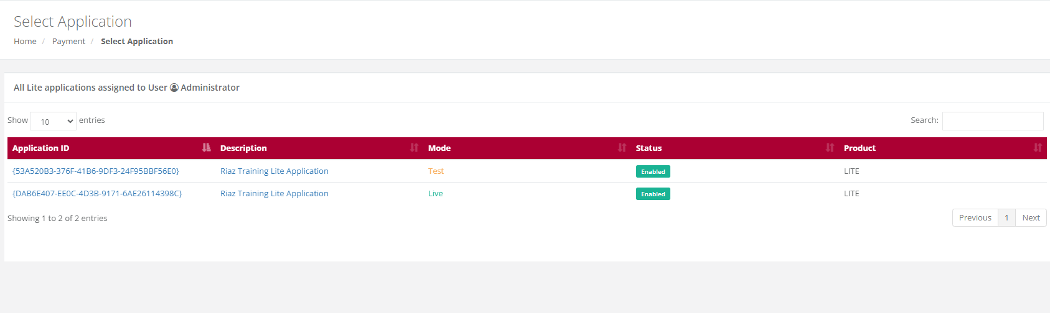

Purpose - To view the list of Successful Orders for a selected Date or Period in order to check these against your confirmation emails or to view ALL details related to individual transactions.

Action:

In the menu bar, Mouse over Lite Transactions - View - Successful. If you only have one Application ID, this page will NOT be displayed, and you will be automatically taken to the Choose Date/Period page.

Choose a specific Application ID

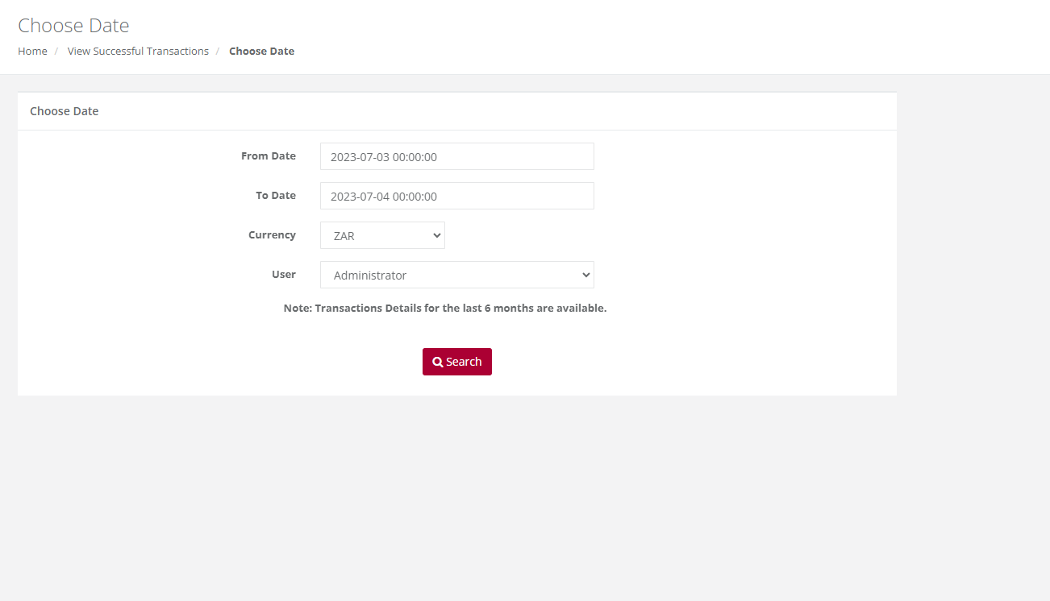

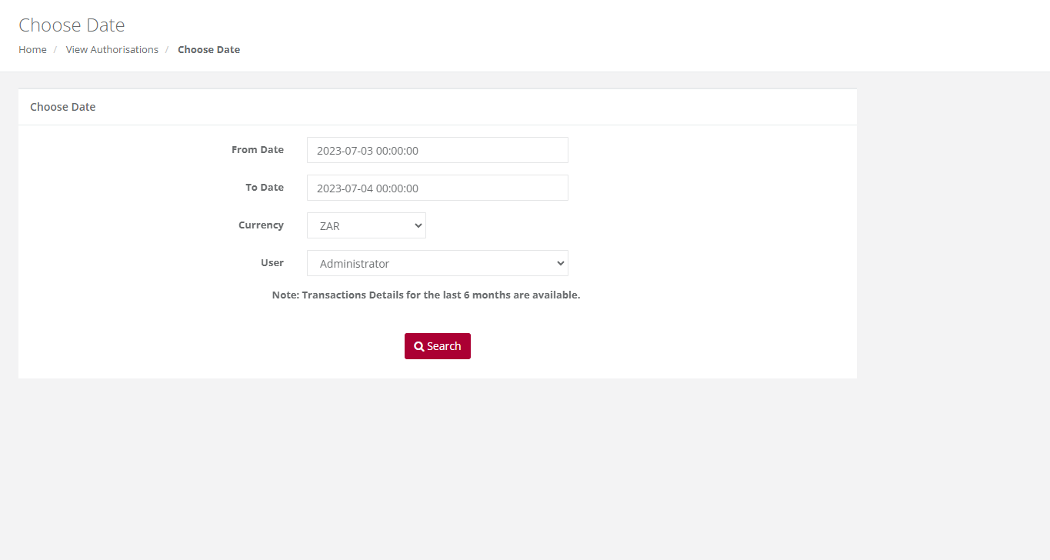

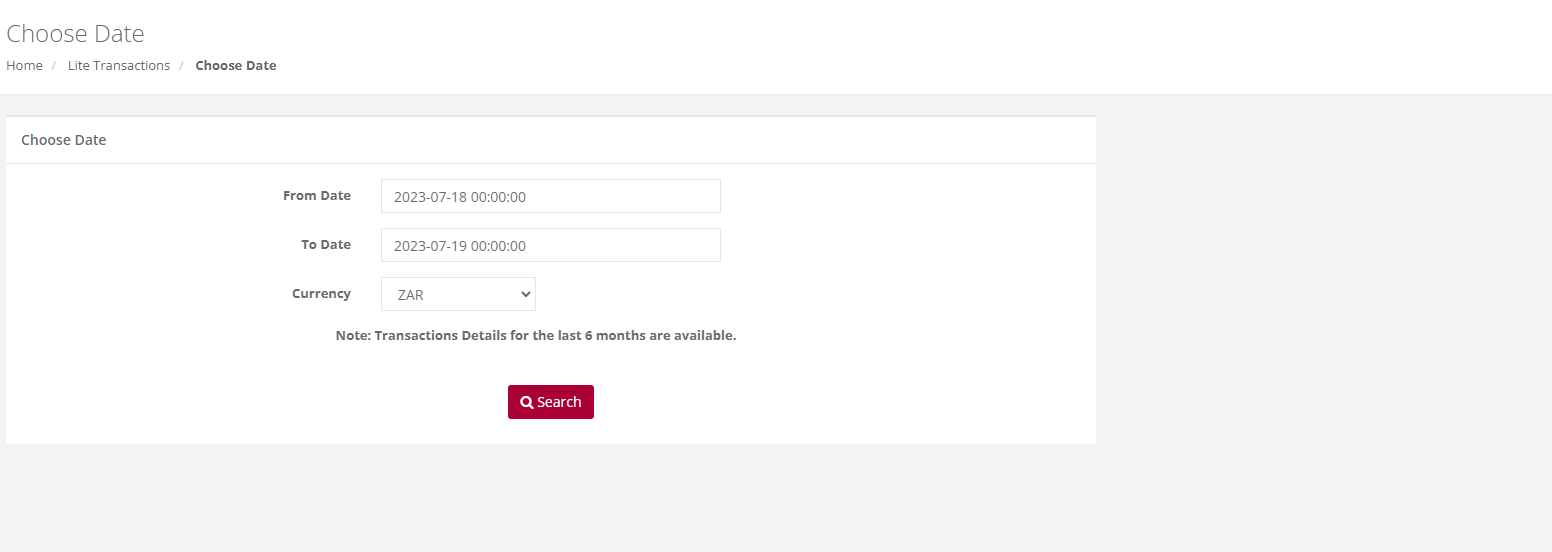

Choose a date range to start your Search

Transactions – View -

Successful

Purpose - To view the list of Successful

Transactions

for a selected Date or Period in order to check these against your confirmation emails or to view ALL details related to individual transactions.

Action:

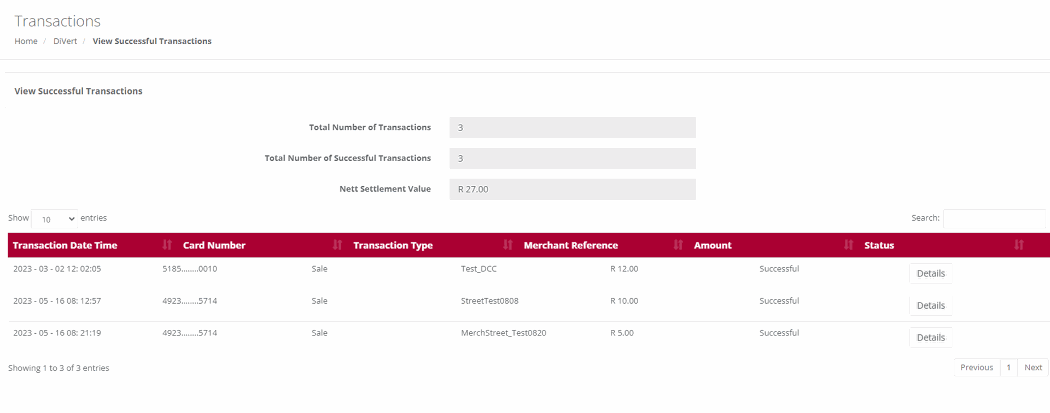

In the menu bar, Select Lite, Transactions, View, Successful. Click on the Application ID you wish to view Successful Orders for. Select the Date or Date range and click on Search. This will bring up the following pages for viewing.

Choose a date and select Search

Action:

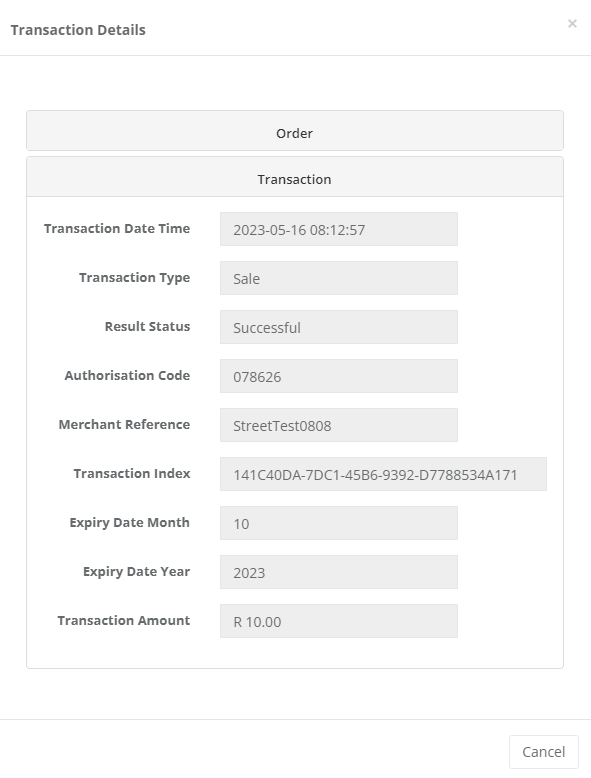

If a user wants to view the details (above) of the transaction, Details is selected to see more information pertaining the transactions.

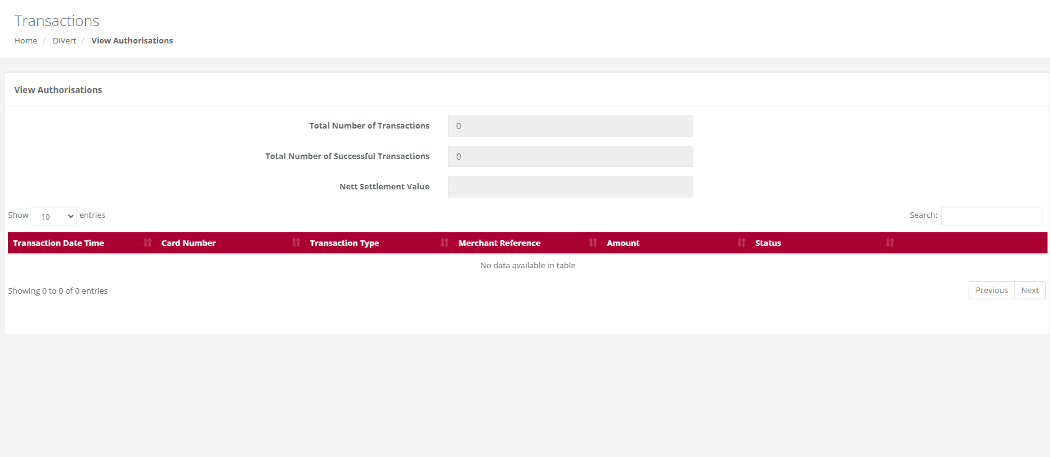

Transaction -View – Authorisations

Purpose - To view the transactions for which you originally only obtained an Authorisation. This allows you to now use that Authorisation code to Debit the cardholder by doing a Subsequent Transaction to debit the cardholder and obtain the money in your bank account.

Action:

In the menu bar, Select Lite, Transactions, View Authorisation. Click on the Application ID you wish to view Authorisations. Select the Date or Date range and click on Search. A list of transactions will be displayed

Choose a date and select Search

Action:

This will give you the below screen reflecting the details of the Authorisation for either viewing of the details or you can print this page for use at a later stage.

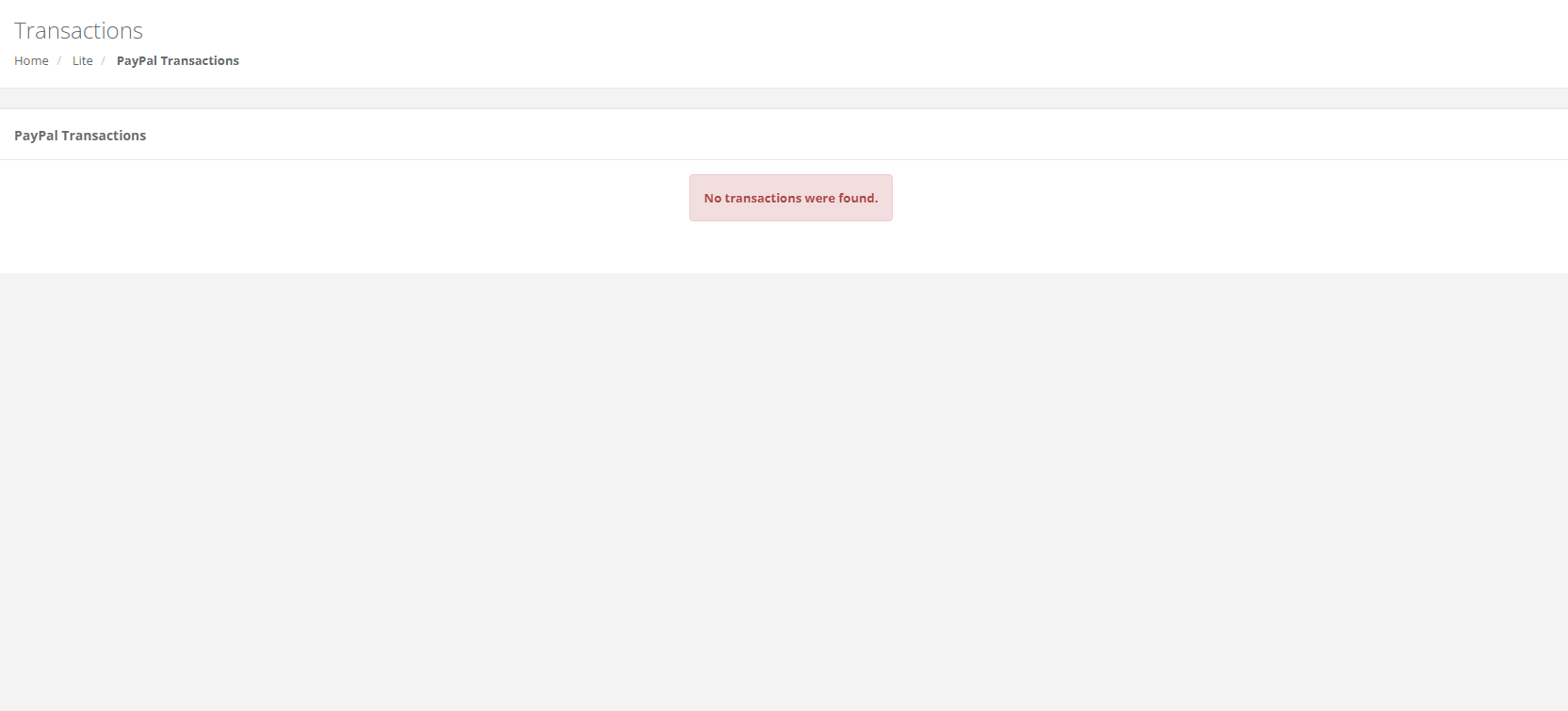

Transaction -View – PayPal

& Interbank Transactions

Should the merchant be processing the following transactions these tabs are also available for the merchant to view and search these transactions.

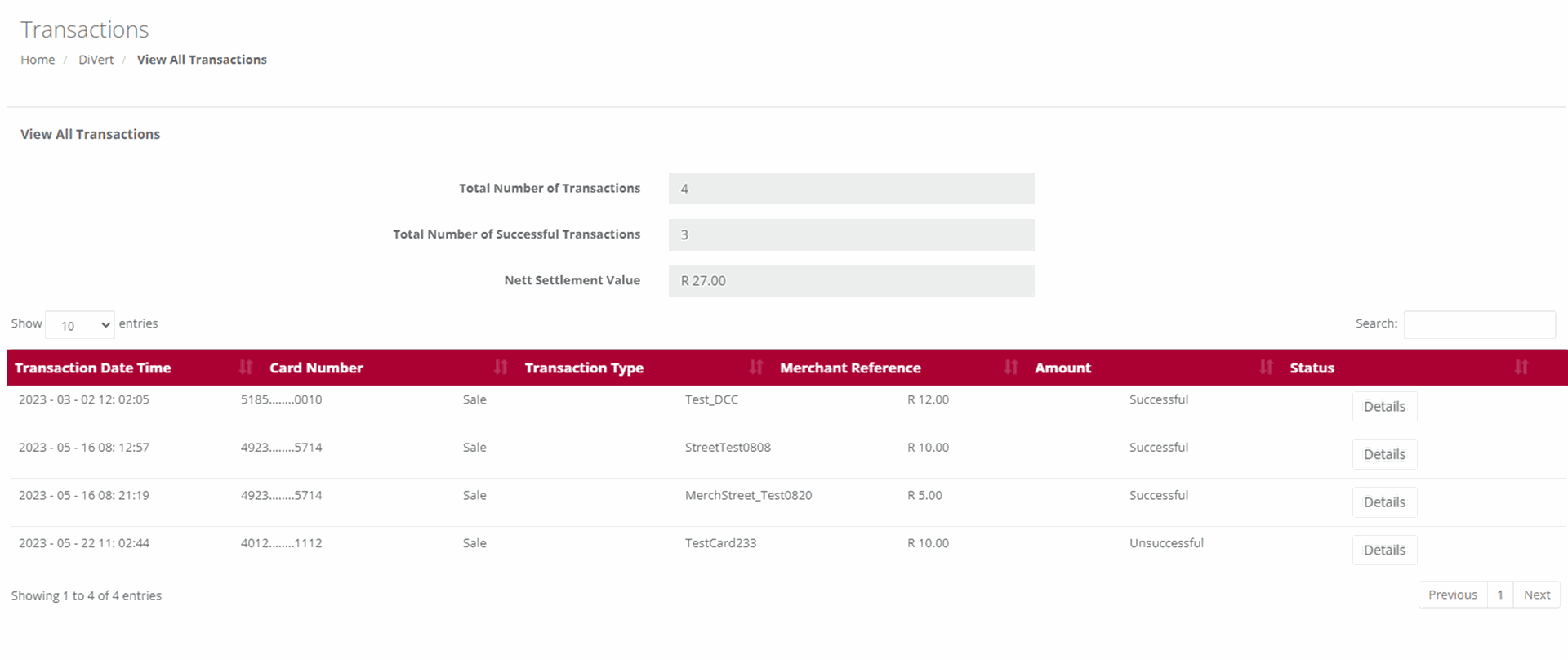

Transactions

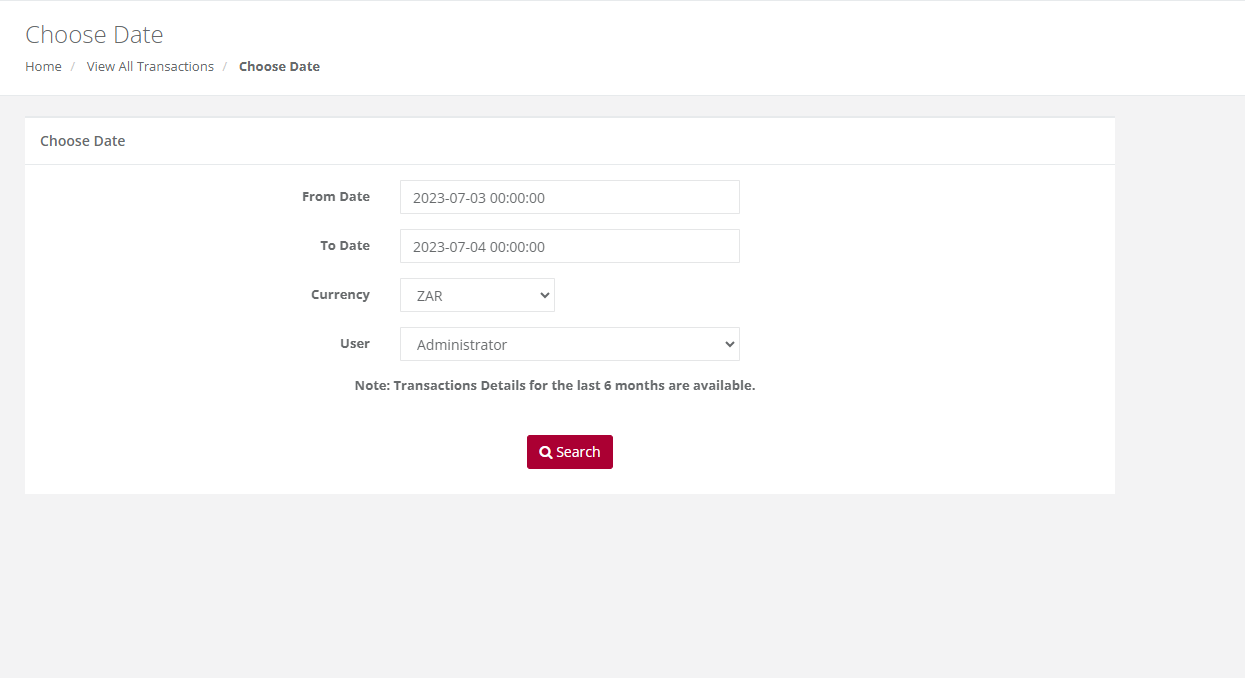

- View – All Transactions

Purpose - To view a list of all transactions performed for a selected Date or Period.

Action:

In the menu bar, select Lite, Transactions, View, All

Transactions

. Click on the Application ID you wish to view Transactions. This will bring up the list of ALL transactions performed for your selection.

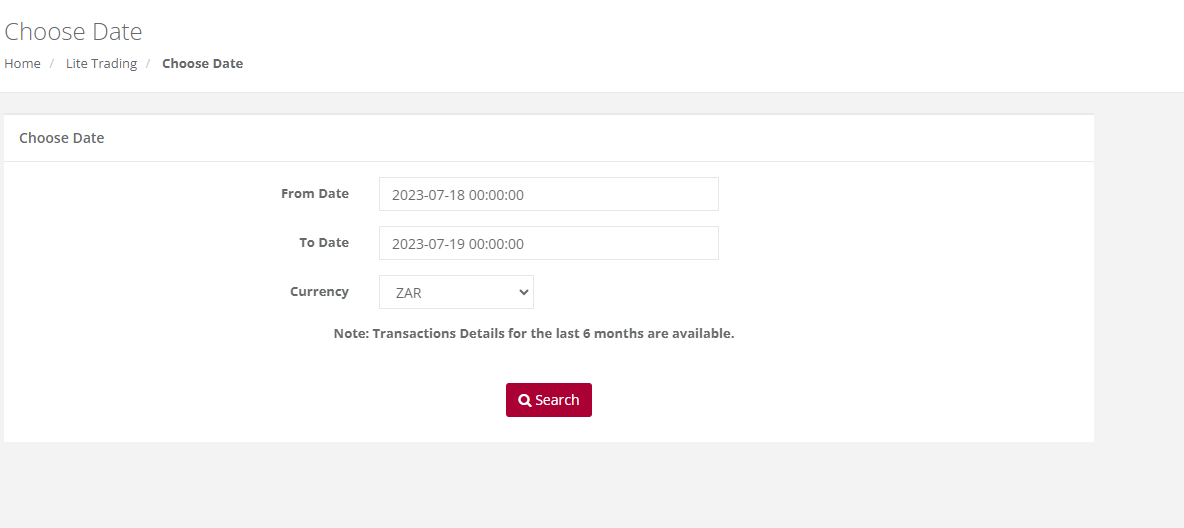

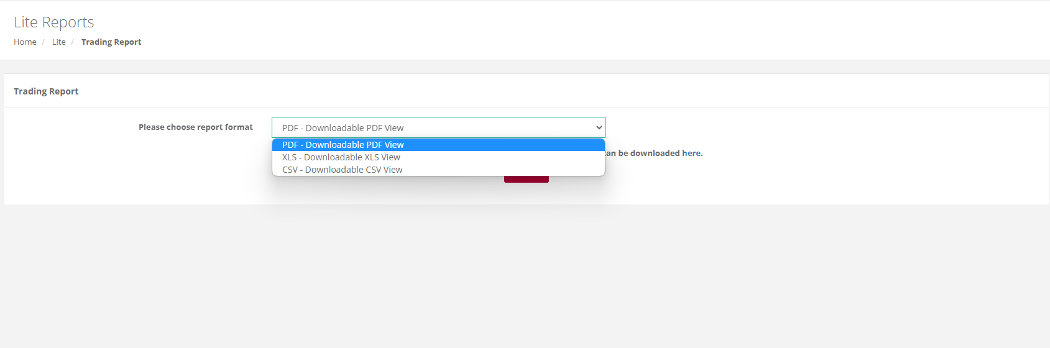

Report

– Lite Trading

Purpose - To print a report of processed transactions on a specific Application ID.

Action:

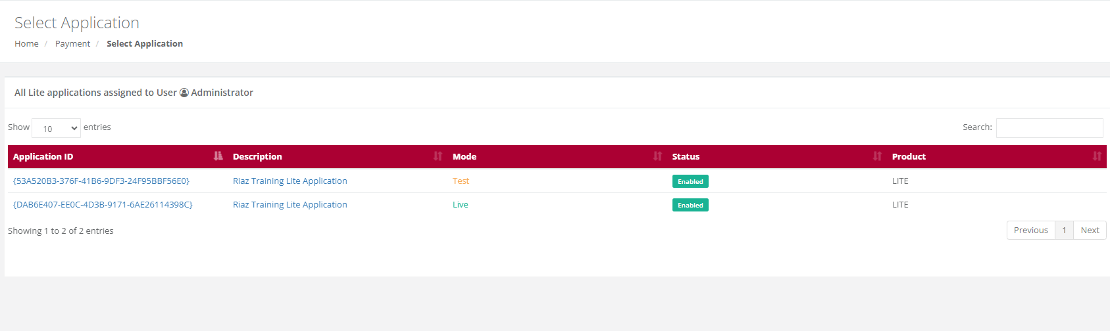

In the menu bar, select Lite - Transactions - Reports - Trading Report. Click on the Application ID you wish to view Transactions.

Choose a date and select Search.

This will bring up the list of ALL transactions performed for your selection.

Transactions details for the last 6 months are available.

Choose the applicable file format to download the trading report on a particular Application ID

Transaction – Payment

Purpose - This function allows you to pass a credit to any card without having a previous debit transaction. There is a limit to the amount that you can process a credit transaction for. Please speak to your Acquirer to obtain this limit.

Action:

On the main menu bar, Click on Lite – Transactions – Payments , select the relevant Application ID. A Capture Transaction screen will be displayed.

Once the an application ID is selected, the system will allow you to manually capture and do the transaction, however this would require all the card details to be inputted and the set limits to be adhered to.

Transaction – Subsequent Transaction

Purpose - Subsequent transactions allow a user with the correct permissions to further action a transaction that has been successfully processed. For example, a user can change the transaction type from an Authorisation to a Sale or from a Sale to a Refund.

Action:

From the menu, select Lite - Transactions - Subsequent Transactions.

Action:

Click on the appropriate Application ID in which you can view transactions that have been processed. Once the transactions details are displayed you, perform refunds, or do a debit

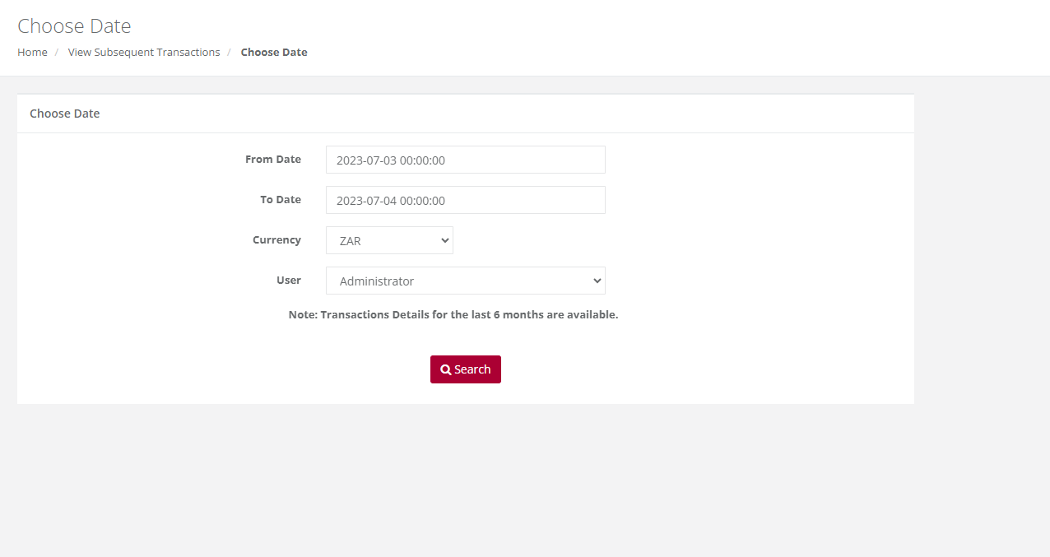

Action:

Select the Date on which the original transaction took place from the drop down menu or select a period if you are not sure of the exact date and click on Search. This will bring up a summary list of all the transactions which match your search selection.

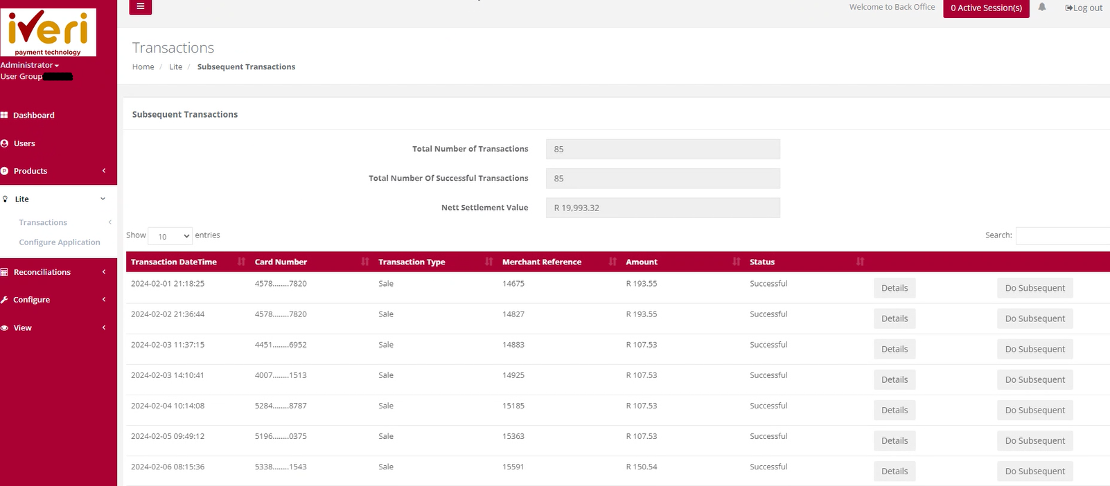

Action:

Scroll through the summary list until you find the transaction you want to take the action on. To make sure that it is the correct transaction, click on the Details button on the right to bring up the full details of the transaction. To complete the subsequent transaction process click on the 'Do Subsequent' tab.

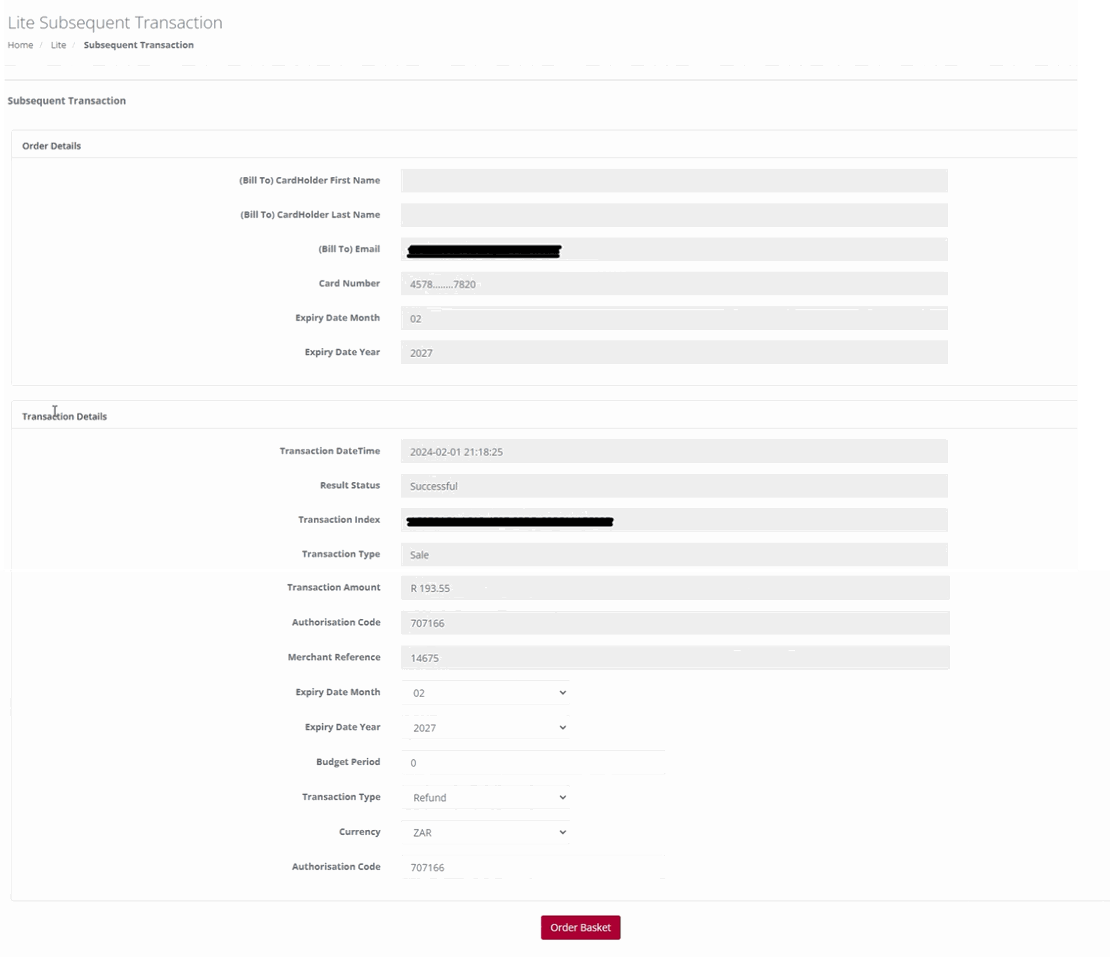

Action:

The subsequent transactions form pop-up will appear. As you can see the transaction automatically changes the transaction to refund. The user can click on the 'order basket' tab.

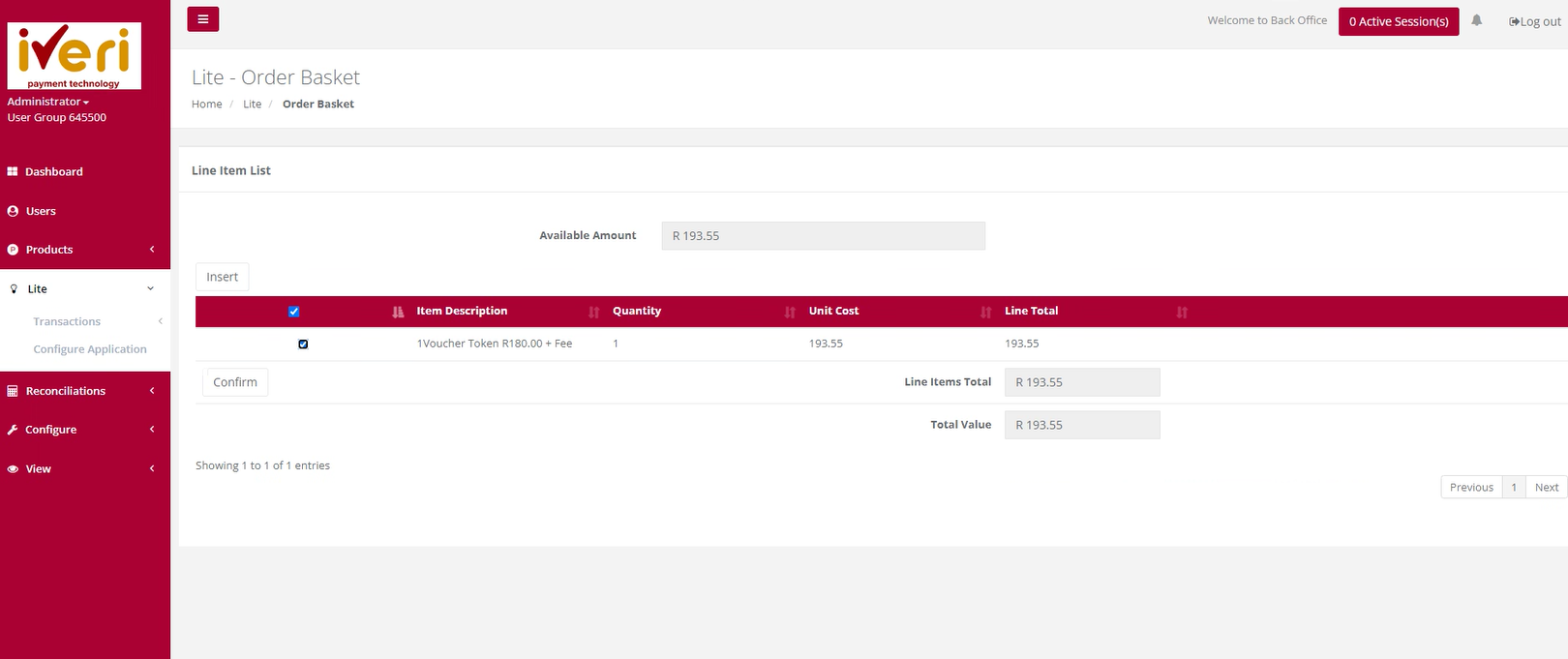

Action:

The user would now select the line item they would like to refund, by ticking the checkbox. Click on the 'Confirm' tab once the selection has been made.

Action:

The 'Transaction Details' pop window will appear. To complete the subsequent transaction, the user will click on the 'Do Transaction' tab.

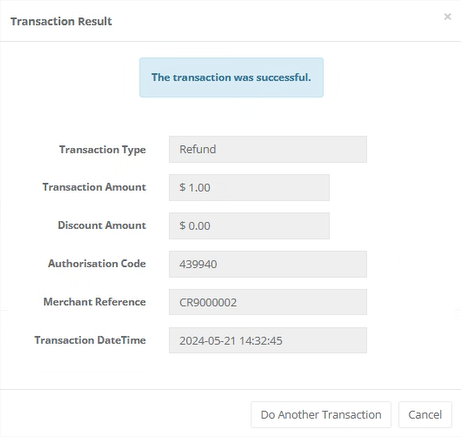

The following result page will appear confirming that the subsequent transaction was successful.

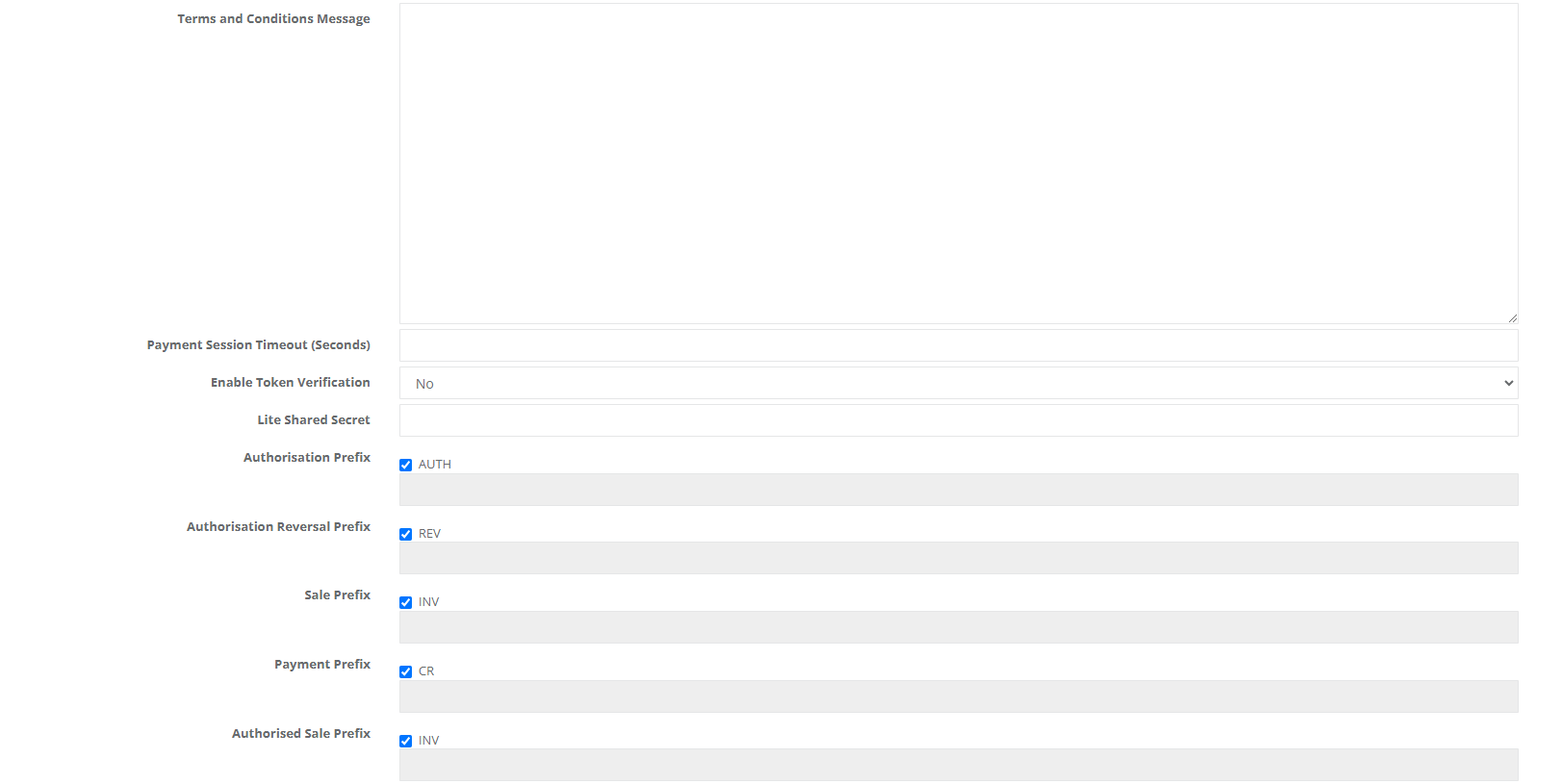

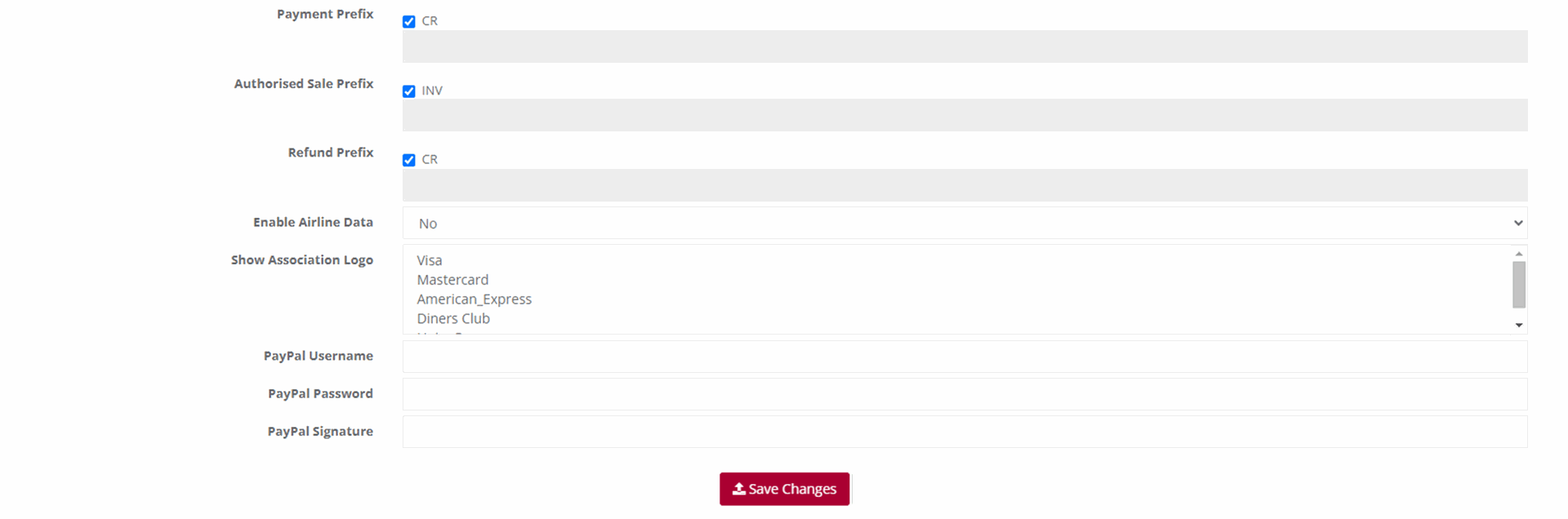

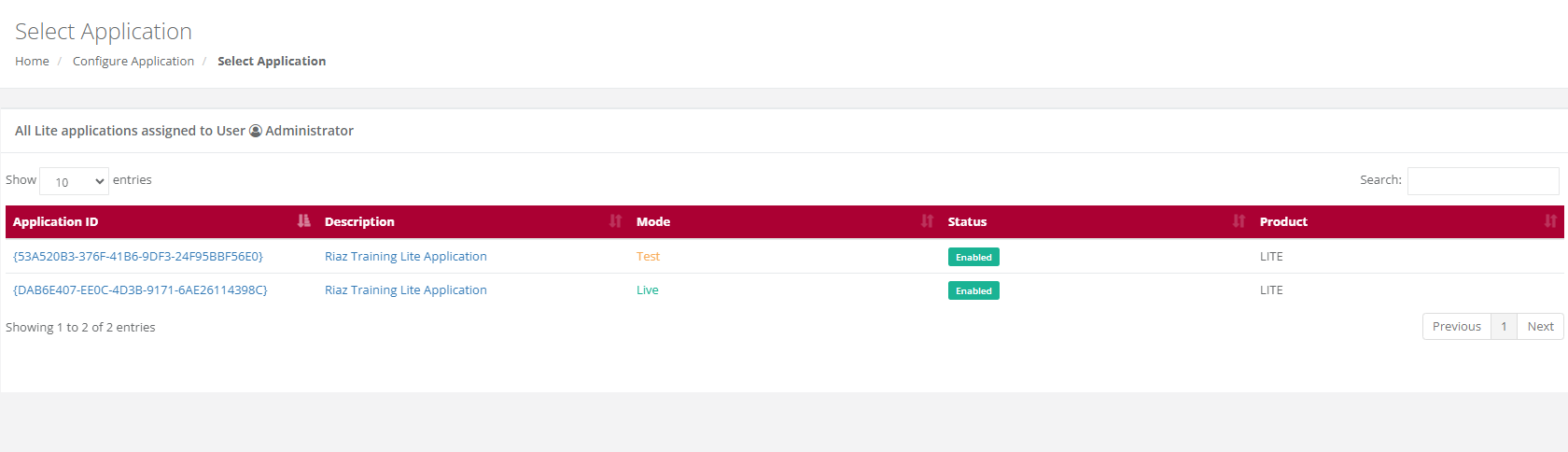

Configure Application

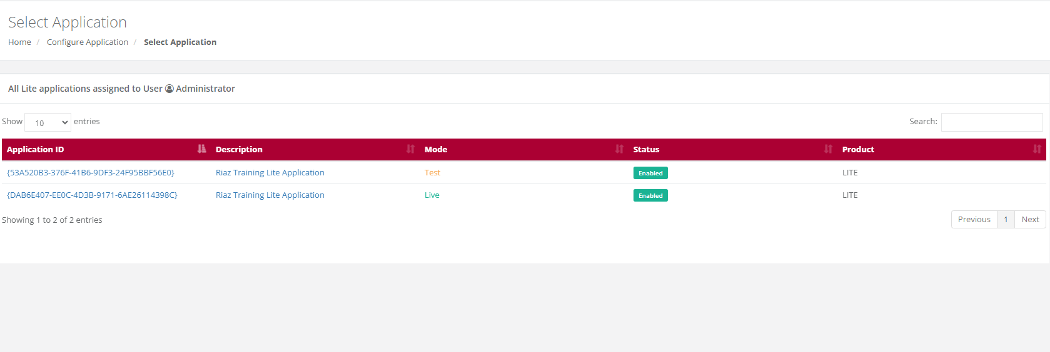

Purpose - To receive e-mail confirmations after processing successful transactions and to set-up your transaction viewing preferences, you will now need to set up your choice of transaction configuration.

Action:

On the main menu go to Lite – Configure Application.

Action:

Click on the Application you want to configure, i.e., either the Test or the Live. Make the relevant changes and click on Submit

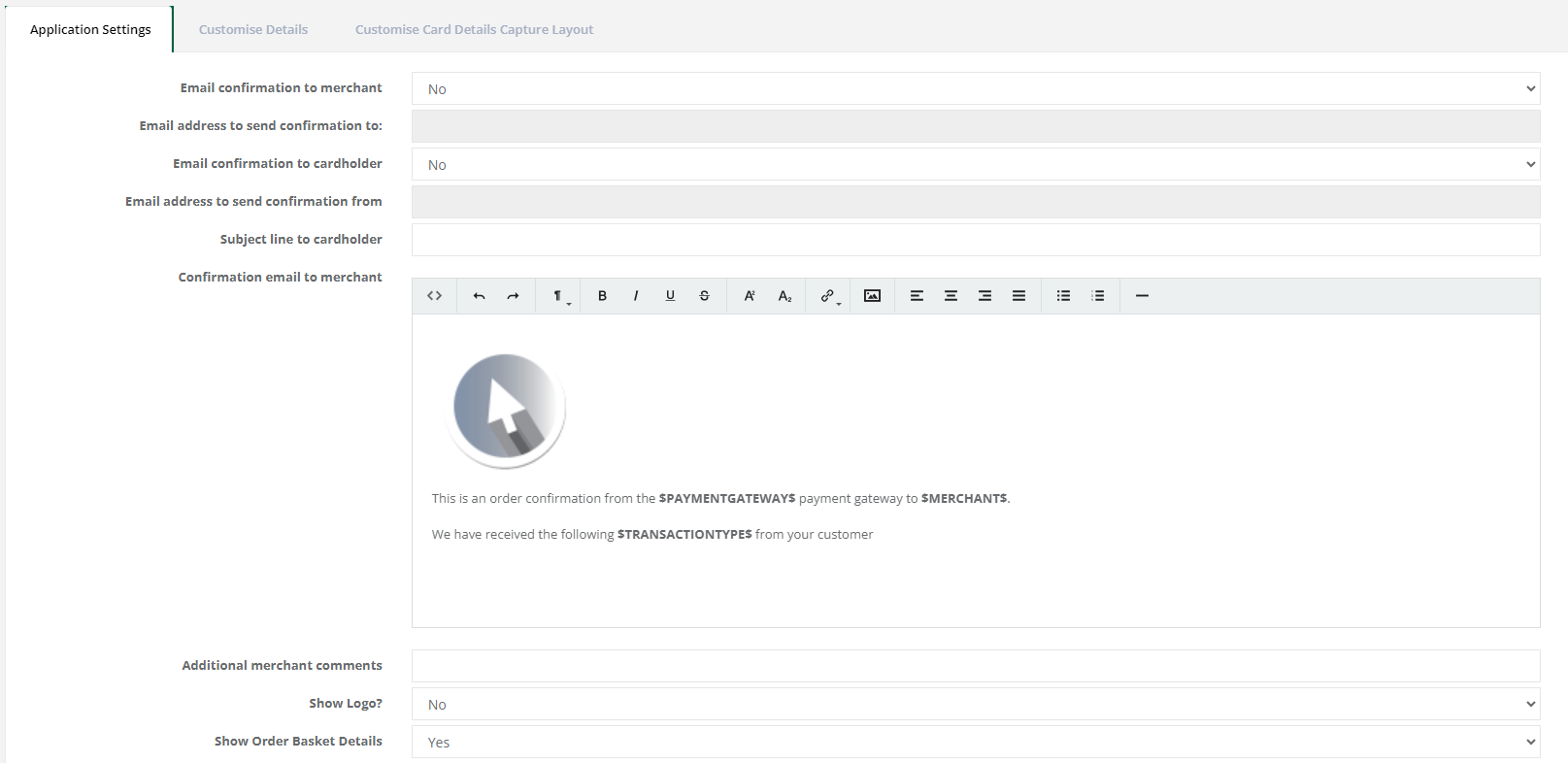

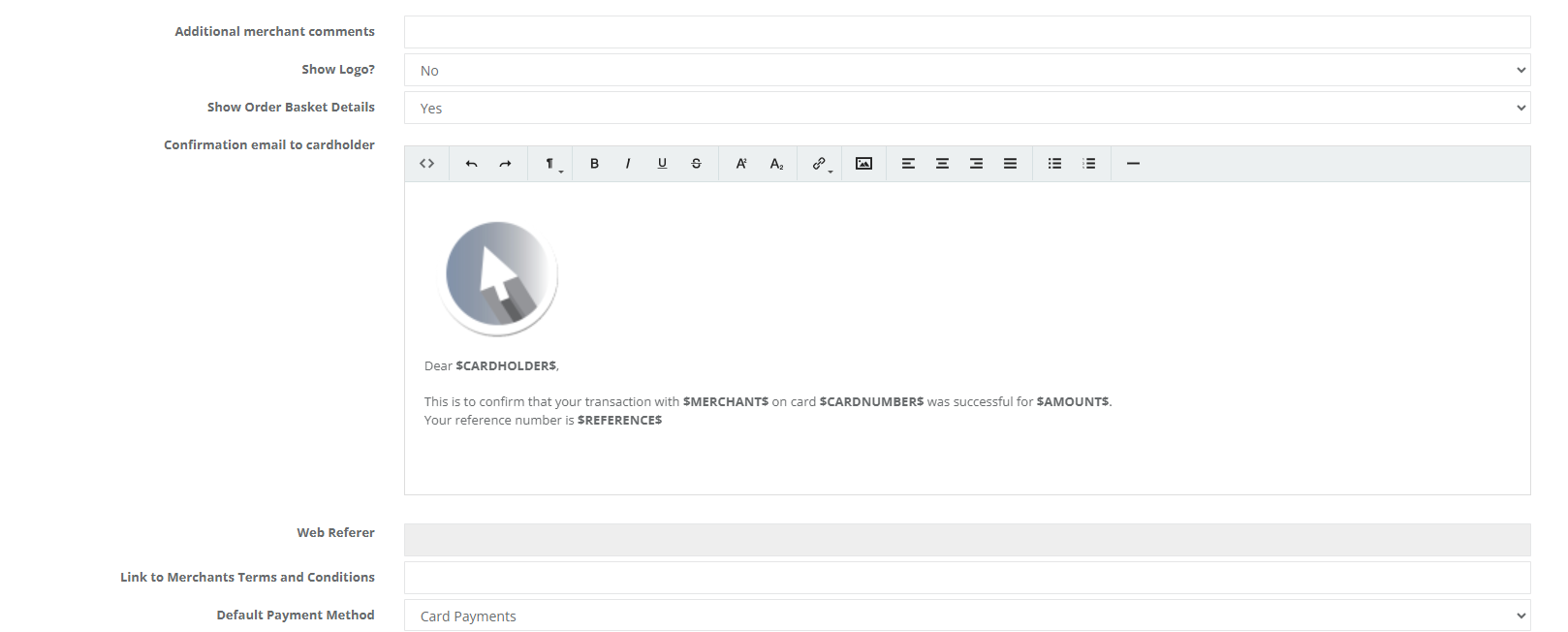

Below are some of the details a user would need to configure under Application settings:

- E-mail confirmations can be sent to a cardholder.

- Confirm the E-mail address confirmations are sent to and from.

- Customise the message on the payment page.

- Customise the message on payment request e-mail.

- Copy or Link Merchants Terms and Conditions

- Show Associated Logos

To make the relevant changes, click on Save Changes.

NOTE:

The Administrator can configure specific user email addresses to receive confirmation emails when payments are made by cardholders. Here’s how:

Send Email Confirmation to the User Who Created the Request: Enable this option to allow the user created by the Administrator to receive transaction confirmation emails.

Send Email Confirmation to a Different Address: Alternatively, enter a different email address in the provided text field to receive transaction confirmation emails.

Send Email Confirmation to the Cardholder: Enter the email address where the cardholder's transaction confirmation emails should be sent.

Customizing Payment Request Messages

Customize the payment request message sent to the cardholder. Ensure not to alter the content between the $ signs.

Preferred Payment Method Selection

Merchants with multiple payment methods can select a default option from the list, such as Visa Checkout, MasterPass, or Card Payments.

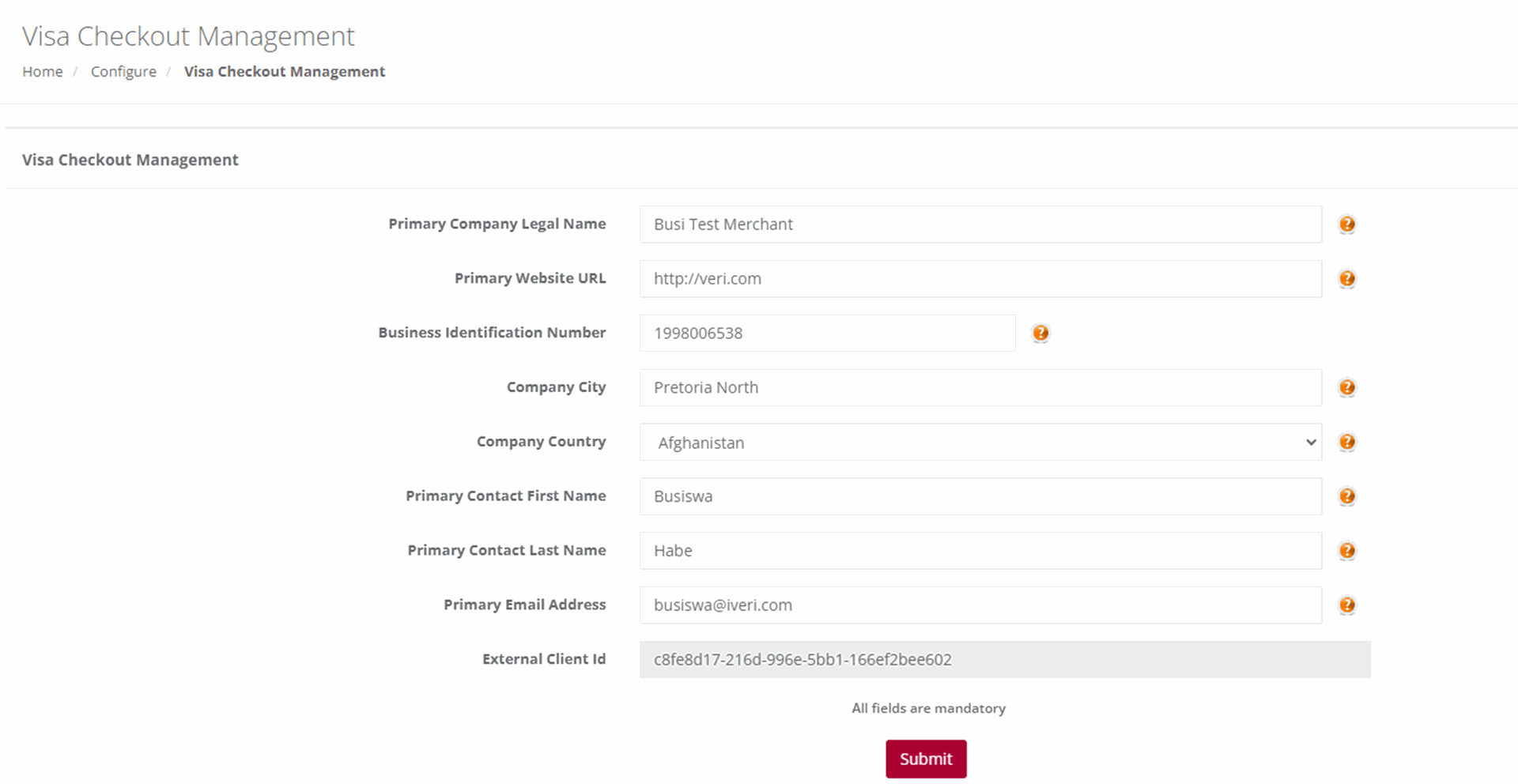

Registering for Visa Checkout

To start accepting e-wallet payments via Visa Checkout, follow these steps:

Navigate to the “Transaction Viewing Layout” section.

Click on the “Reset Transaction Viewing Layout” dropdown.

Select “Visa Checkout Management.”

Click the “Submit” button.

A new page will display, where you can fill in the required fields and submit the form.

Important Note:

Merchants must notify their Acquiring Bank to enable Visa Checkout. This step is crucial for the activation process.

Linking Terms and Conditions:

The merchant can now be able to configure terms and conditions to be set and agreed by the cardholder upon making a payment. This is done by inserting a URL link where the merchants’ terms and conditions are found or type out the Terms and conditions.

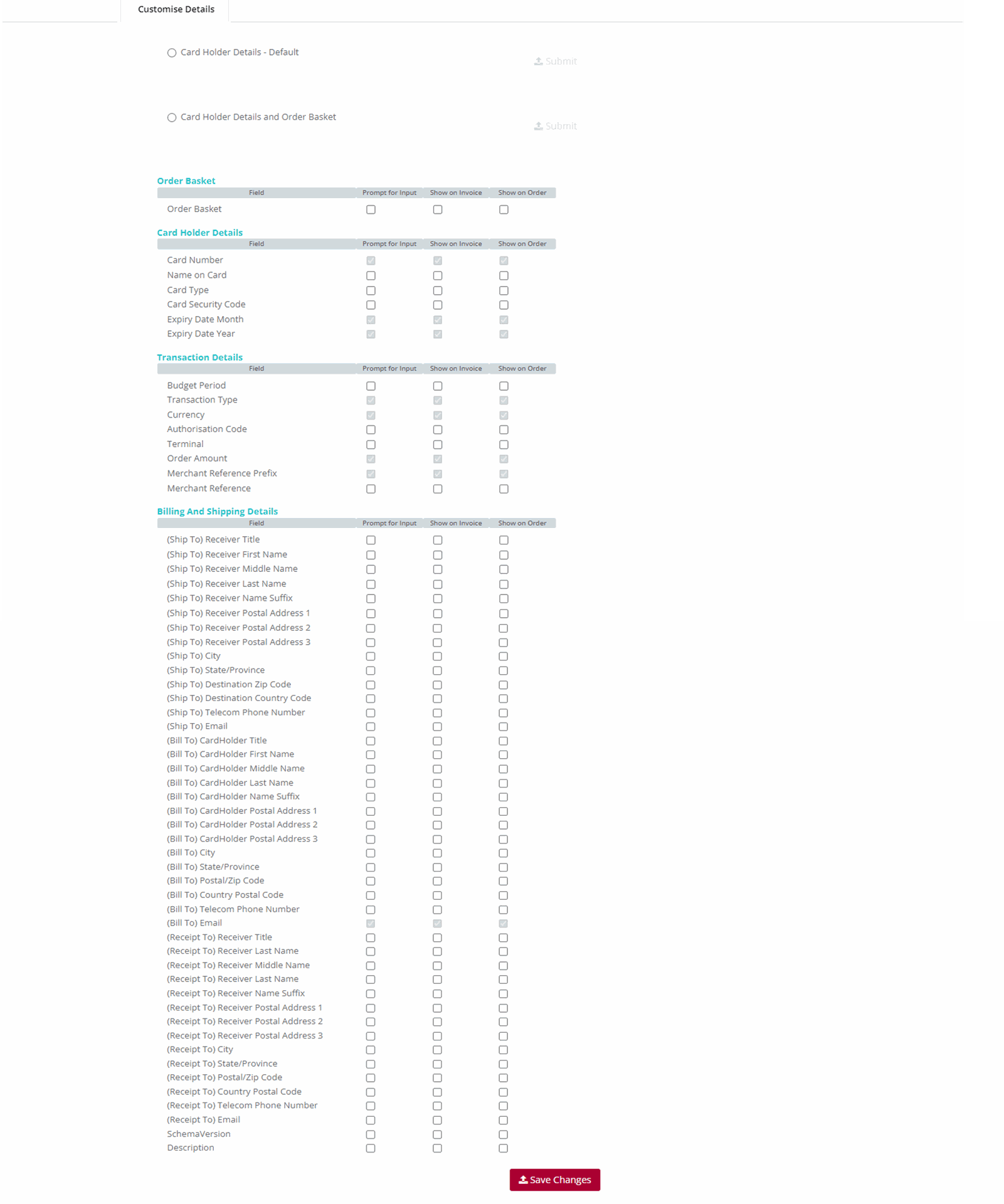

Customize Details

Purpose:

Configuring your application is important. Configuring your application needs to take place before a user can process transactions. Lite users need to configure and customise the details pertaining to:

- Order Basket

- Card Holder details

- Transaction Details

- Billing and shipping details

Note:The fields that are ticked and greyed out are mandatory fields that cannot be configured.

The merchant can configure the fields that they feel are applicable and determine whether the fields require a prompt for input for the cardholder, appear on the invoice and/or show on the order details.

How you want the basket details to look like on the payment page.

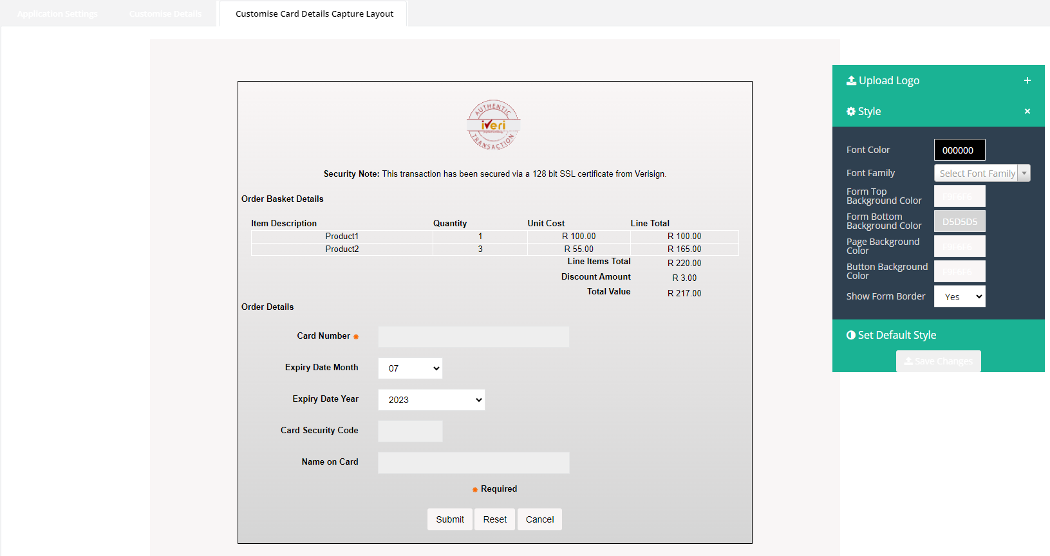

Customize

Card Details Capture Layout

Purpose:

From the ‘Customise Card details capture Layout page, the Administrator can customise the look and feel of the payment page.

This is a preview of the defaulted payment page that cardholders will see.

Action:

From the main menu the user will navigate to: Lite - Configure Application.

Action:

Select the applicable application ID.

Action:

The user will select the 'Customise Card Details Capture Layout' tab.

Action:

The user can upload the company logo to align with their company’s Corporate Identity. JPEG and PNG are the accepted file extensions.This can be done by clicking on the "Upload Logo" expansion button. The user will be able to access the assets from their PC and upload the file extension.

Under 'Style', the user will be able to customize the following:

- Font colour

- Font type

- Form top background colour

- Form bottom background colour

- Page background colour

- Button background colour

- Choose to have a border around the payment section

- Choose whether to display company logo on the payment page.

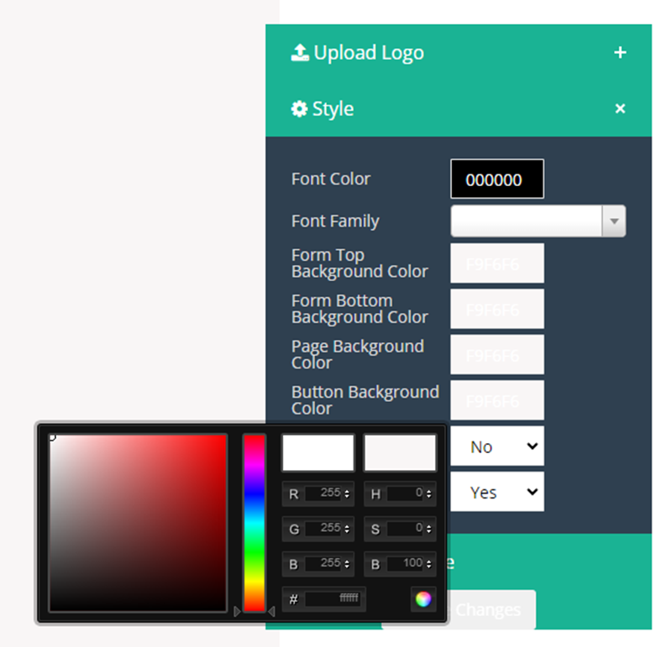

To customise the above, the user will do the following:

Action:

Expand on the "Style" tab.

Action:

Select which field to customise. In this example, we will customise the Background by click in the box provided. This will populate the colour spectrum.

The user can also utilise the RGB model and Hex code available to customise the colours according to their corporate identity.

Action:

Once the user has customised the colour, they would need to click on the colour wheel, to maintain the changes they have made. Should the user not do so, the style will return to it's default setting.

Lastly, to save the changes that have been made, click on the "Save Changes" tab.

Please note:

If the user would like to reset to default settings, select the 'Ser Default Style'.

Reconciliation

Print Report

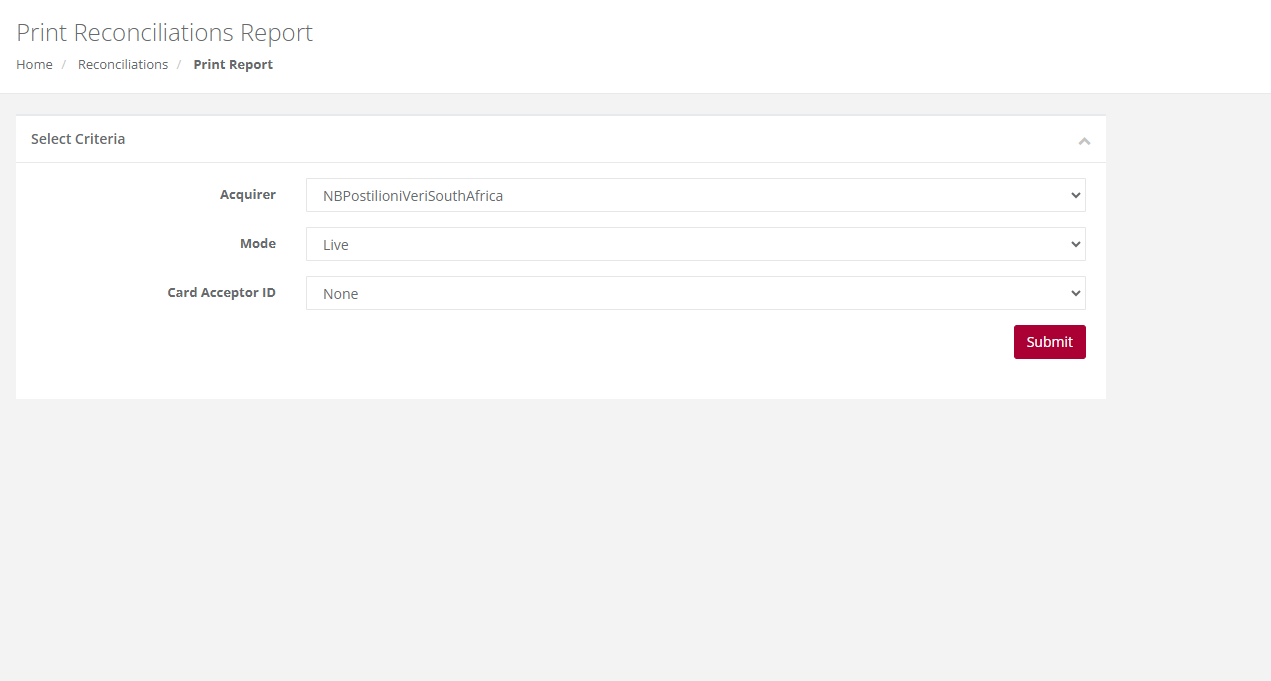

Purpose - To View/Print/Save reconciliation file for a specific acquirer cycle/settlement period in either:

PDF

XLS

CSV

Action:

From the main menu the user will navigate to: Reconciliations - Print Report.

Action:

If you have only one Merchant Card Acceptor ID, simply click on Submit. If you however have more than one, then click on the drop down and select the Card Acceptor ID for which you want the report before you click on Submit.

The following screens and points highlight the various parameters that need to be selected before viewing the report.

Action:

The user can select their preferred Recon Layout and Recon format.

Find the acquirer cycle number you want to view and click on the actual cycle number. It will download automatically for you to view.

Please Note:

If your file contains more than 10000 records, then the time in the message above will show 20 minutes. It is recommended that you click on the words Click Here and you will receive an email when your file is ready for retrieval.

Download Reconciliation

Purpose - To download and save the selected reconciliation file in XML format.

Action:

Mouse over the menu function Reconciliation then click on Download File. This will bring up the following form

Action:

If you have only one merchant Card Acceptor ID, simply click on Submit. If you however have more than one, then click on the drop down and select the Card Acceptor ID number for which you want the report before you click on Submit. Select the cycle you wish to view.

Please Note:

If your file contains more than 10000 records, then the time in the message above will show 20 minutes. It is recommended that you click on the words Click Here and you will receive an email when your file is ready for retrieval.

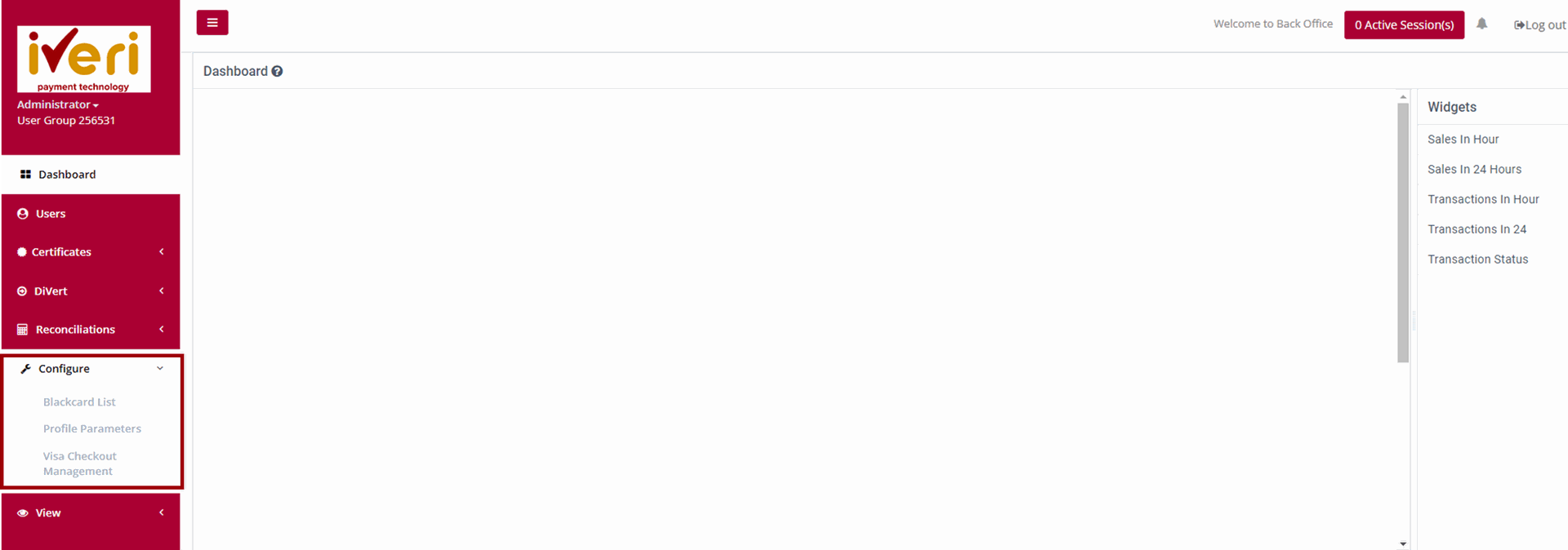

Black Card List

Purpose - This configuration allows you to compile a list of credit card numbers that you wish to decline. Before forwarding any transaction to the bank for processing, the iVeri gateway will check this list. If a card number matches one on your list, the transaction will be instantly rejected. The reasons for adding card numbers to this list are determined by each merchant individually and will only result in rejections by your business.

Action:

from the main menu, navigate to: Configure - Black card List.

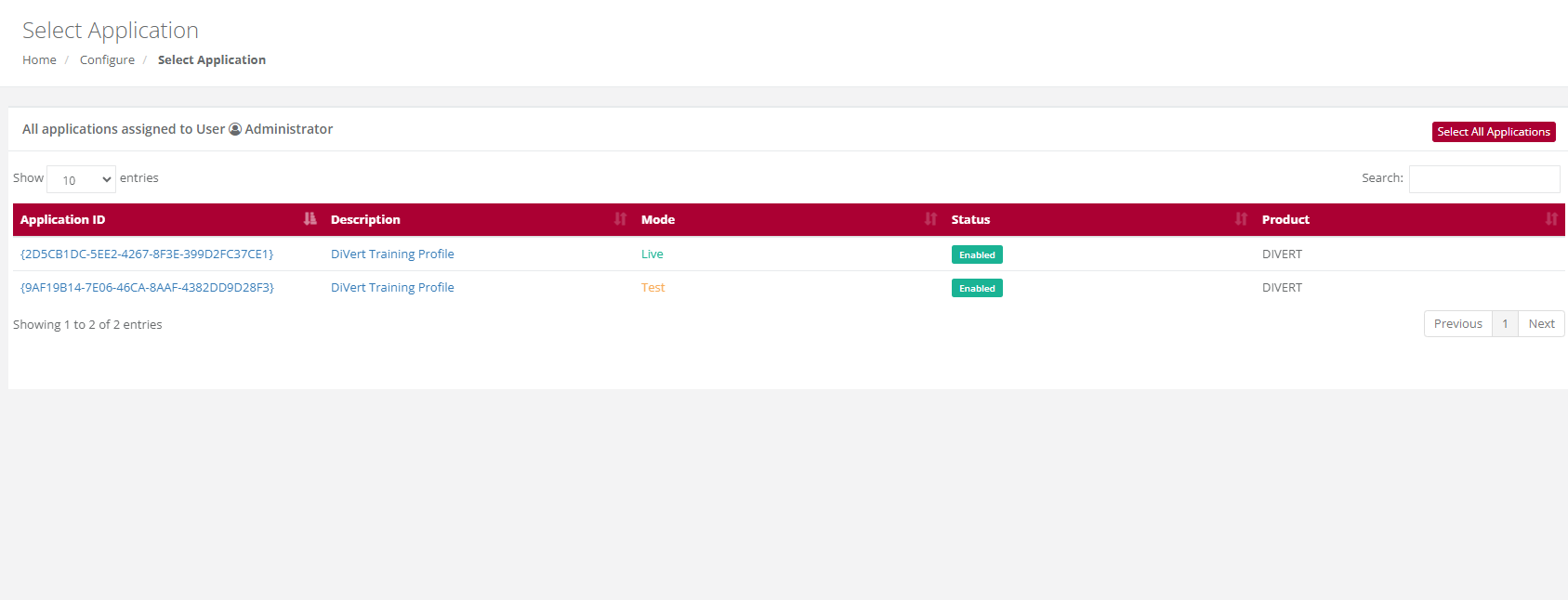

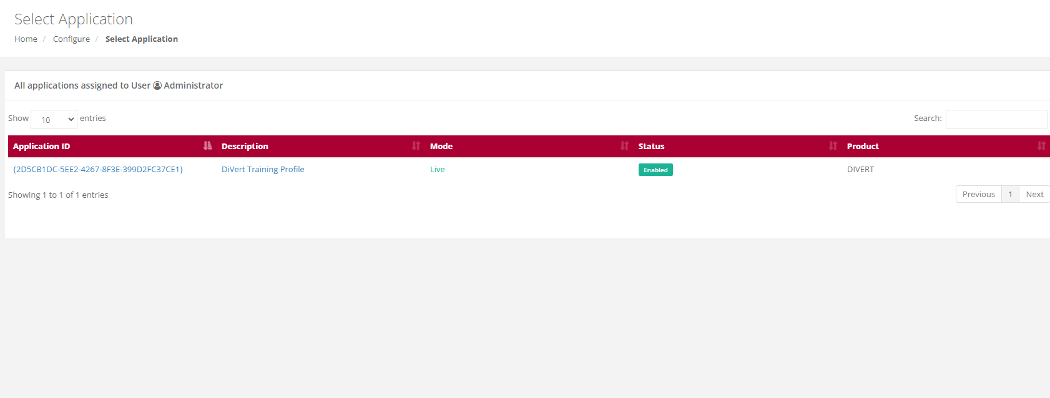

Action:

If you have more than one Application ID and want to capture the card number to be blocked for all your applications, click on Go next to All Applications at the top. If not, then click on the Application ID in the bottom section and the next page will be displayed.

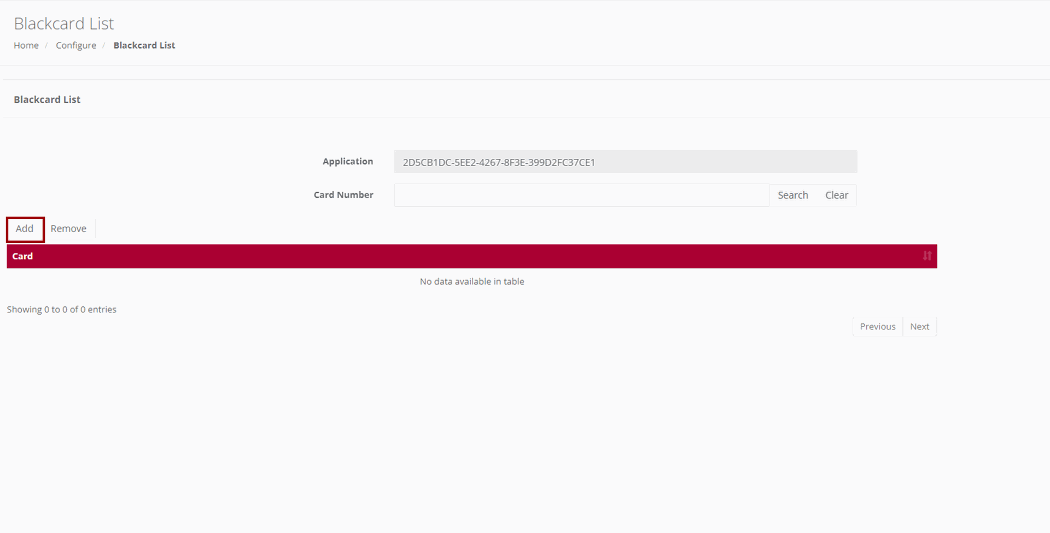

Action:

Enter the credit card number you wish to add to your Black Card List and click "Add." This will include the card number in your list. If you have multiple numbers to add, input each one and click "Add" after each entry. Once finished, click "Submit" to save your entries.

To search for a number, type it in and click "Search" to check if it’s already on your list. If the number is found, it will be highlighted. To remove a number from your list, enter the number, click "Search," and when it is highlighted, click "Remove." Then, click "Submit" to save the change (removal).

Profile Parameters

Purpose - To set the Security Parameters for all users in terms of their passwords, validity, suspension, and login notifications. These parameters can only be set by the Back Office Administrator.

Action:

In the menu bar, click on User Manager, scroll to, and click on Security Configuration. This will bring up the following form on which you can now change the system defaults to suit your own requirements. Please remember that changes made to the defaults will apply to ALL users that you have given BackOffice access to

Note:

- Strong Password: The default is No. This means that the password can be anything if it is not less than the default minimum length. If you change the default to Yes, then the user’s password must be a combination of alpha/numeric and special characters also not less than the default minimum length.

- Minimum Password Length: The default is 6. You can change it to any higher number. If you do then this number will apply to ALL users.

- Strong Username: The default is No. This means that the username can be anything if it is not less than the default minimum length. If you change the default to Yes, then the username must be a combination of alpha/numeric and special characters also not less than the default minimum length.

- Minimum Username Length: The default is 4. You can change it to any higher number. If you do then this number will apply to ALL users.

- Enforce Password Change: The default is No. This means that users will never be forced to change their passwords. If you change the default to Yes, then all users will have to change their passwords in accordance with the Password Change Frequency that you set next.

- Password Change Frequency (days): The default is 60 days. This default is only valid if you change the Enforce Password Change default to Yes. If you do this then you can also change this number of days default to a longer period.

- Auto Suspend Users: This is used to automatically suspend a user from accessing Back Office after a set period. The default is No. If you want to suspend ALL, the users after a certain period of time then change the default to Yes.

- Auto Suspend After Period (days): The default is 60 days. This default is only valid if you change the Auto Suspend Users default to Yes. If you do this then you can also change this number of days default to a longer period.

- Login Notification to Administrator: This is used if the Administrator wants to know every time a user logs in to Back Office. The default is No. Simply change this to Yes and the Administrator will be notified by email every time a user logs in to Back Office.

- Keep Password Unique: This is used to set the period after which a user can use the same password again. The default is One Time. What this means is that when a user’s password expires after the default period of 60 days or the new period set by the Administrator, the user will have to enter a new password in accordance with the relevant settings above. They can then use their original password again after this period has expired. If you want the period longer before a previous password can be used again, select one from the drop down If you select Always, then the user will have to choose a new password every time their password expires.

- After changing any of the default settings above, click on Save to effect your changes. The Administrator can change any of the above at any time.

Visa Checkout

Visa Checkout Merchant Take-On

Merchants can also register for Visa Checkout to start accepting e-wallet payments from cardholders. To register merchants can mouse to the “Transaction Viewing Layout” section click on the “Reset Transaction Viewing layout dropdown, select “Visa Checkout Management” click the “Submit” button. A new page will be display and the merchant can be populating all the fields displayed on the below screen and Submit.

NB: The merchant will also need to notify the Acquiring bank that they need to be enabled for Visa Checkout.

View

Transaction Lookup

Purpose - To lookup the details of a single transaction based on specific search criteria.

Action:

Click on View then Transaction Lookup

Action:

Click on the Application ID on which you want to do the lookup e.g., Live or Test

Action:

Select the Date on which the transaction took place by changing the default date or by clicking on the calendar icon next to the date. If you are not 100% sure of the date, you are able to search in a range of up to + or – 2 days of the date you have selected by changing the 0 default to 1 or 2 in the +/- Days drop down next to the date.

You then need to enter either the Transaction Index or the Merchant Reference number. If you do not have either of these numbers you are able to enter either the full credit card number or a partial (first four numbers …….. last four numbers) AND the amount. Click on search.

The result/s (summary) will be displayed on screen. Click on the summary of the transaction to obtain all the details pertaining to the selected transaction.

Transaction History

Purpose -To obtain a list of transactions for a selected calendar period reflecting all the result details for each in XML format.

Action:

Click on View then Transaction History

Action:

To view Transaction history, .click on the appropriate Application ID, Live or Test

Action:

Make your selection of period/time in the above form by manually changing the default dates or using the calendar icons next to each date. Also select file format i.e. XML or CSV. Once done click on Download. Your file will be open or downloaded to selected folder

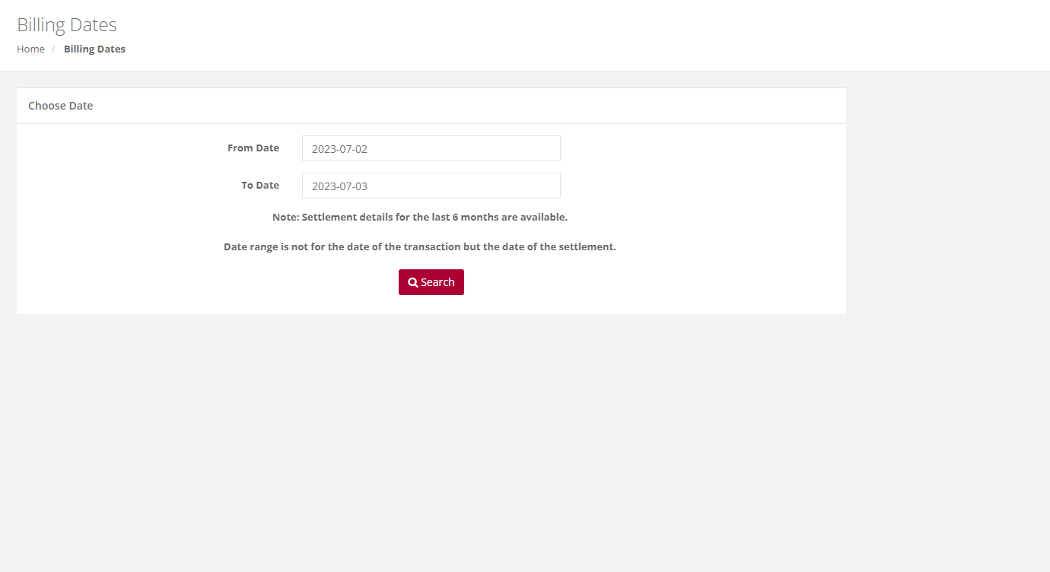

Billing

Purpose - This feature shows the Billing that is in place for this merchants’ transactions. The list of transaction and what is being charged to the merchant, this will appear here.

Note: the plus sign provides details as to how this amount is calculated.

Action:

Click on Billing

Action:

Choose a date to search for transactions processed at a certain period.

Transaction will appear

Settlement

Purpose - This detail information provides the merchant the view based on what they will be settled on based on processed transactions. It also provides a breakdown on what could have been retained by the acquiring bank and what is due to them as the merchant. iVeri will then settle the merchant once the acquirer settles the funds to iVeri.

Action:

After the user clicks on settlement, select the date range for the settled transaction. (The image attached should follow on from the image where the user clicks on the ‘settlement’ tab).